Welcome, prop.text readers!

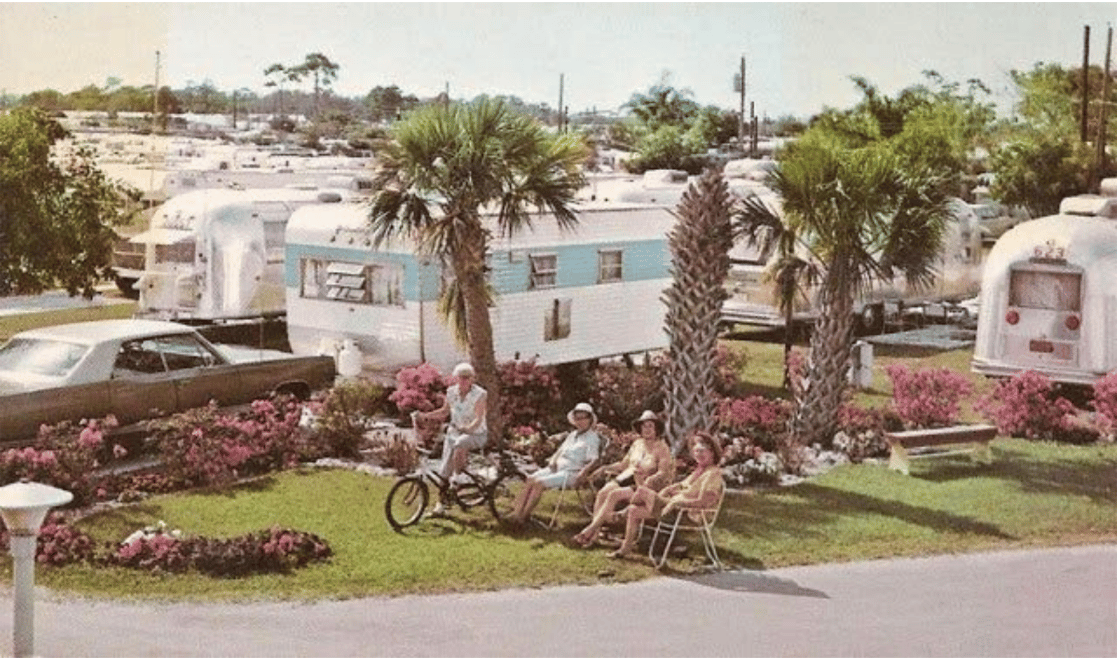

In issue 42, we dive into the world of mobile home park investing.

publicly.traded → Investor Takes a Swing at High-End Market

industry.chatter → Bubble watch: highest ricks areas

charts → Rent growth stalling out

Mobile Home Parks Offer a Strong Investment Upside

Prop.text is a strong advocate for investing in the single-family residential (SFR) sector, but we’ve also written about recreational vehicle (RV) parks, Delaware Statutory Trusts, co-living spaces, short-term, mid-term and long-term rentals, parking lots, among other strategies.

But we have yet to write about mobile home parks, and given the demand for affordable housing and its crushing shortage across the US, this feels like the time. MHPs are one the last affordable housing options, and they are also in short supply. Also, it’s difficult to get a new MHP built, further constraining supply. (Spare us the trailer park jokes — most of the people living in these communities are hard-working people who, either because of bad luck or the accident of birth, are on the bottom rung of the income ladder.)

For those considering a foray into MHP investing, beware that there is some stiff competition.

Institutional investors have been flooding the space for more than a decade, according to a New Yorker article from 2021, noting they are “assets that generate steady returns and require little effort to maintain.” The article goes on:

Several of the world’s largest investment-services firms, such as the Blackstone Group, Apollo Global Management, and Stockbridge Capital Group, or the funds that they manage, have spent billions of dollars to buy mobile-home communities from independent owners. … In 2013, the Carlyle Group, a private-equity firm that’s now worth two hundred and forty-six billion dollars, began buying mobile-home parks, first in Florida and later in California, focussing on areas where technology companies had pushed up the cost of living. In 2016, Brookfield Asset Management, a Toronto-based real-estate investment conglomerate, acquired a hundred and thirty-five communities in thirteen states.

The article went on to detail how these financial industry giants often increased rents on the pads and instituted new fees, for services like garbage removal, and installing water meters and charging residents for them. MHP owners are not responsible for the maintenance of the homes in their parks, which are the responsibility of the residents.

In addition to the rent for the pads, many MHP residents have payments on the structures, which are generally not as mobile as the name implies. Most residents are reluctant to move the mobile home if rents increase, so park turnover is quite low. But it is difficult for these folks to move up the income ladder, because these trailers depreciate in value, unlike a stick-built home, and owners are not building equity.

The Oracle from Omaha is part of the competition as well. Warren Buffet’s Berkshire Hathaway subsidiary, Clayton Homes, is the biggest mobile home manufacturer in the US, and it also profits from high-interest rate loans since Clayton urges buyers to go through a loan company also owned by Berkshire. Its loan portfolio was put at $13.7 billion, and brought in $765 million in 2017, according to Forbes. In the past, Buffet has defended Clayton, which was accused of predatory loan practices, saying the company’s lending practices were sound.

There are many resources for the prospective investor, including Mobile Home University, which offers three-day online courses for $1,749 (two tickets for $2,499), with the next session scheduled for Jan. 9-11 of next year.

Eager students might want to look beyond the video on Mobile Home University’s home page that lays out the case for buying an MHP and click on the link to The New York Times Magazine story from 2014 to get a clearer picture of what an investor can expect. The authors of the articles, books, courses and boot camps for Mobile Home University are Frank Rolfe and Dave Reynolds, who are the 5th largest owners of mobile home parks in the US with a portfolio of over $500,000,000 in parks and a 30-year track record, according to its web site.

There is money to be made in the sector, but the usual caveats apply: do your homework, and do your due diligence.

Vintage Capital pivoted to a limited partnership (LP) model for MHPs in 2021, after nearly a decade of buying and operating parks.

“We are fund-to-fund advisors,” Tom Briccetti, head of investor relations at Vintage Capital, told proptext. “It’s a bit of an opaque space compared to multifamily.”

Vintage has contacts in the industry, giving them a wider pipeline for sourcing deals, and since they partner with operators in multiple regions, they can pick and choose where to buy. The company says it has placed more than $100 million in assets for more than 300 investors in the MHP sector.

“We act as an access point to an area that is hard to access,” Briccetti added.

Lucca Carmignani, who works in investor relations for Vintage, said the company has a “sweet spot, in terms of size,” for the MHPs it targets.

“We fall into the 60-300 (pad) range,” Carmignani said, “where you still get the scale without it being too competitive with private equity.”

During a recent webinar for the Entrust Group, which specializes in helping investors set up self-directed IRAs, Vintage co-founder Brad Johnson emphasized the company’s buy-and-hold strategy.

“Vintage is really set up for the long term,” Johnson said during the webinar. “We’ve done a fair amount of refinancing of these assets, and once we have our capital back, we can continue to collect the cash flow.”

Of course, there are downside risks to investing in MHPs, like any real estate deal. These include:

Buying in a market that loses a large employer it relies on for jobs.

Maintenance and costly repairs of older infrastructure — many MHPs are more than 50 years old.

There are about a gazillion operators who would be willing to take your money to invest in an MPH, including the Debt-Free Doctor, whose video says that buying eight parks has changed his life. The good doctor offers a 21-video series called the Dr. Wealth Academy, that promises to “unlock your full potential, and transform your life” for $297 — for lifetime access.

Vintage says it targets a 15-17% for its internal rate of return on funds and pays out monthly distributions, with a goal of 7% cash-on-cash returns in years two to three. Once they are able to refinance a property, often after they have made some improvement, they will get their return on capital and settle in for the long-term cash flow.

Among the cities with the highest real estate bubble risk, Miami tops the list, followed by Tokyo and Zurich, according to this year’s edition of the UBS Global Real Estate Bubble Index. Global home prices have been static in inflation-adjusted terms over the last four quarters, with affordability issues tamping down demand. UBS analyzed residential property prices in 21 major cities around the world, and though prices are high in coastal American cities like San Francisco and New York, they seem reasonable when adjusted for inflation. Companies calling their employees back to the office, and strong growth for AI start-ups and finance firms that pay well, translates into higher demand from a cohort with money to spend on high-priced housing.

Sellers are taking their homes off the market rather than letting them linger. Nearly 85,000 homes listing were pulled in September, up 28% from a year earlier and the highest level for that month in eight years, according to an analysis by Redfin. A listing is considered “stale” if at least 60 days have elapsed from the home’s original listing date, and some 70% of US home listings were “stale” in September, and many properties delisted in September had been on the market for 100 days before being pulled. Roughly 15% of these properties were at risk of selling at a loss, the highest share in five years.

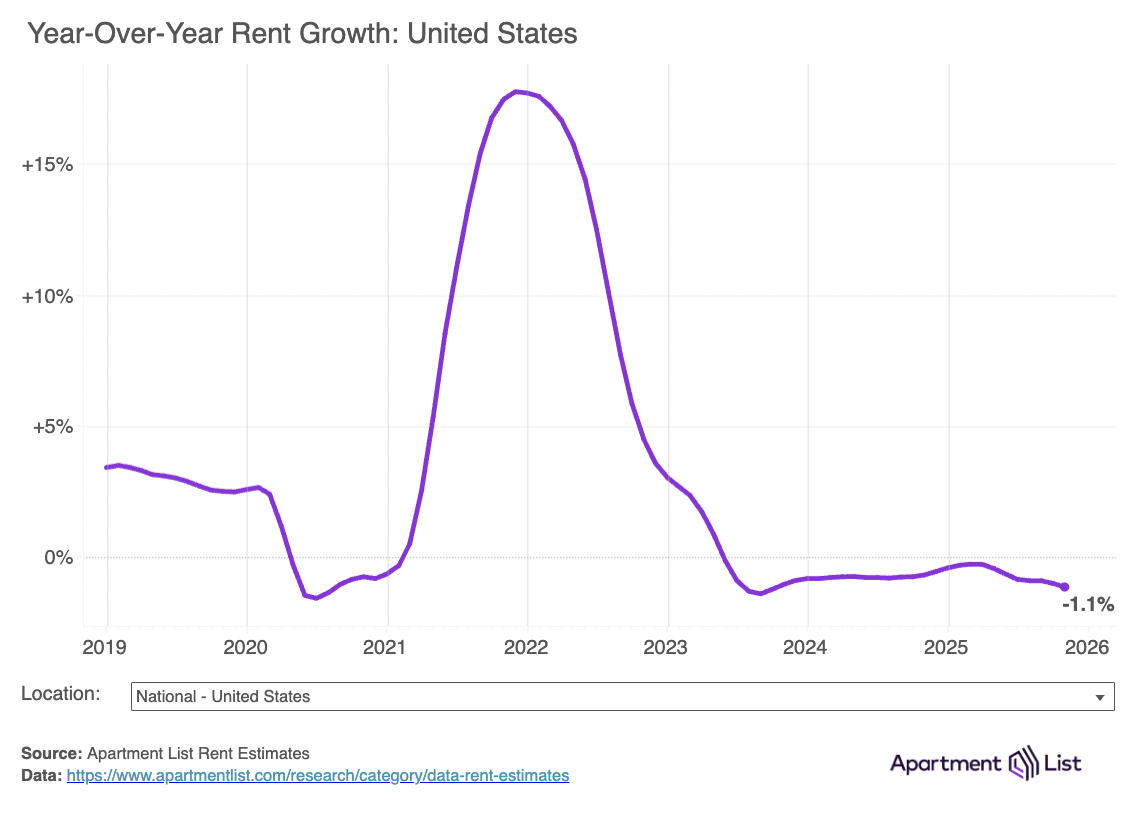

Good news for renters, bad news for multifamily landlords. Average apartment rents fell last month to $1,708, 0.3% less from September's revised figure of $1,713, according to a report from CoStar's Apartments.com. The decline in October was the largest drop in more than 15 years as an oversupply of units affects all parts of the country. The West had the highest decrease in October, 0.53% month-over-month, followed by a 0.28% slide in the South and a 0.24% drop in the Northeast. Rents in the Midwest fell 0.18%. The Midwest posted the highest annual growth rate at 2.2%, followed by the Northeast at 1.8%. The South's rents remained unchanged year over year, while those in the West declined by 1.4%.

Just Because

To get a look at the world’s most expensive real estate markets, head over to the Visual Capitalist. Unsurprisingly, New York City is high on the list (at #2), with an average price of $2,554 per square foot for apartments ranging from about 1,000-2,000 square feet. The principality of Monaco, playground for the wealthy with a population of just under 40,000, topped the list, with an average price per square foot of $3,603. Hong Kong, London, Saint-Jean-Cap-Ferrat, Paris and Sydney fell into the top seven. Out of the top 20 cities, according to data from Dec. of 2024, six were French and four were American, while Italy and Switzerland had two each. If you are planning to move to Monaco, get out your checkbook: its golden visa program requires a 500,000 euros (about $578.000) in a local institution before you can move there.

There are 54 large metropolitan areas across the country that have a population over one million. After a slow November, rents declined month-over-month in 52 of these markets, and rents are down year-over-year in 29. Rent trends vary significantly by region, with annual declines currently concentrated primarily in the South and Mountain West regions. Meanwhile, many markets in the Northeast, Midwest, and parts of the West Coast continue to see prices trend up despite the winter slowdown.

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}