Welcome, prop.text readers!

In issue 37, we explore wall street’s new real estate play: parking lots.

publicly.traded → Parking lots are the new investment thesis

industry.chatter → Million dollar listings are moving the most

beyond.the.curve → Housing starts, active listings and inventory

Wall Street Now Betting Big … on Parking Lots?

We have a soft spot for single-family residential investing, are big believers in mixed use buildings, and have also written about other investment strategies, including mid-term rentals, RV parks, co-living, the upside of ADUs, and now … parking lots?

It was a new one for Kai Ryssdal, the host of Marketplace, who recently had Patrick Sisson from The New York Times on the show to talk about his article on Industrial Outdoor Storage (IOS).

It’s a new one for us as well.

But during construction, whether it be an AI data center, a housing development, or a warehouse complex, “trucks and containers and equipment need a place they can be put, while they wait,” Ryssdal said.

Sisson told Rysdal that this asset class “has been described as a beautiful ugly duckling.” The key to its success, Sisson said, is that the supply of places to park this equipment is limited. Supply chain issues that arose during the pandemic exacerbated this and investors realized that these spaces were “really valuable and demand skyrocketed,” he said.

The boom in this sector is also driven by data center construction to feed the demand created by AI. These data centers need to use all the space they can, and extra space is needed for the staging of all the equipment and materials that go into the center’s construction.

According to a report from the Newmark Group, a commercial real estate advisory and services business, investor appetite is driven by four factors:

Large Footprint, Limited Supply: IOS spans an estimated 1.4 million acres in the U.S. but well-located sites remain scarce due to zoning limits.

Strong Rent Growth: IOS rents increased 123% since 2020, more than twice the rate of bulk warehouses.

Low Vacancy: The lack of development and a growing tenant base keep IOS vacancy rates low — about half of bulk warehouses.

Comparable Pricing: In some markets, IOS delivers rents similar to bulk warehouses per acre.

Since 2021, institutional investors have poured more than $4.7 billion in the sector, according to Matt Hunsucker, principal at the development firm Mackenan and founder of IOS List, an industry newsletter. Those same investors, which include pension funds, mutual funds, large banks and asset managers, accounted for less than $600 million of total investments in IOS properties from 2015 to 2020, he said.

The demand for IOS lots that has accompanied the building boom for huge data centers is increasingly drawing some of Wall Street’s biggest firms, according to The Times article:

In August 2024, J.P. Morgan Chase created a $700 million joint venture with Zenith IOS to buy the properties across the country. Zenith expects to close $150 million in deals by the end of this year.

Blackstone said in February it had committed $189 million to a fund with Alterra Property Group, a real estate company, to buy 49 IOS sites across 22 states.

Alterra said in July that it had received nearly $344 million from Truist Financial Corp. and the Bank of Montreal to acquire 64 IOS properties.

The rise in prices for these storage areas is driven by the simple law of supply and demand. Cities and towns are generally not in favor of having more unsightly gravel lots in their borders, so there are not a lot of places to build them. Couple that with the AI boom, the need for large-scale truck parking and other construction, and you have a perfect storm for an easily overlooked asset class.

Mortgage rates bumped up slightly in the last few weeks after a gradual downward trend that pushed them to 6.3%, and mortgage activity fell in the second half of September, according to a report in Homes.com. The federal shutdown that started on Oct. 2 will not help, and the longer it drags on the more rates could drift upward because the lack of data will leave banks guessing. (The jobs report that was due out Oct. 3 was not released.) "If these reports are delayed, the Fed may hold off on adjusting rates simply because they’re flying blind, even if the broader economy calls for action," Selma Hepp, chief economist at real estate data firm Cotality, said in a statement. "While shutdowns can stir up short-term volatility in interest rates, long-term shifts are almost always driven by bigger-picture economic forces."

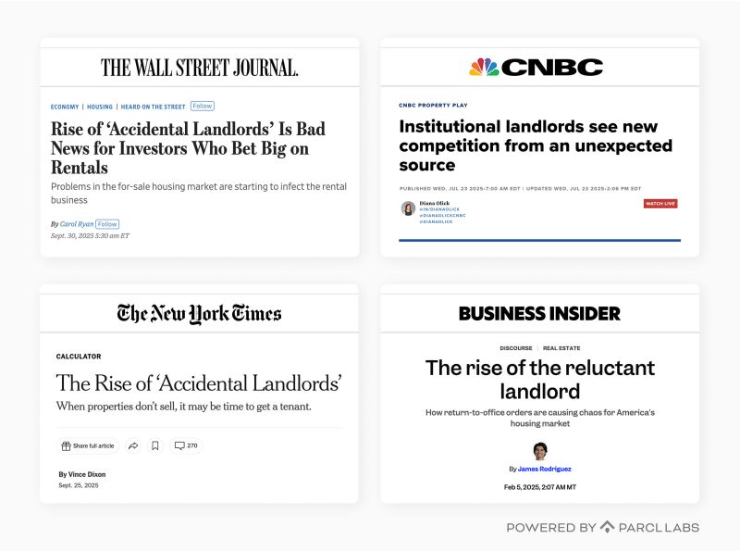

OK, we get it, accidental landlords are a thing. We give our friends over at Parcl labs credit for its mini-viral moment for its research on accidental landlords hitting for the cycle in the real estate media world. The numbers aren’t huge, but are significant and could signal a trend if retiring boomers decide to downsize and leave their homes to their children, and if those children have trouble selling and have the appetite for landlordling. (A big “if.”) Parcl found that accidental landlords have increased in five out of the six Sunbelt cities where 37 percent of the rental homes are owned by large institutions. (Houston, Dallas, Phoenix, Tampa, Fla., Atlanta and Charlotte, N.C.) In Houston, 7 percent of failed listings-turned-rentals in April, a 41% increase over last year. In Dallas, accidental rental properties are now 5% of the market, 32% increase from last year.

Million dollar homes are selling faster than the rest of the market, according to the National Association of Realtors, another reflection of the growing wealth gap. Many first-time buyers have been excluded from a market with persistently high prices and elevated mortgage rates, while the well-to-do are more likely secure in their jobs and flush from the runup in the stock market over the last few years. Buyers who are moving up the housing ladder generally have a fair amount of equity, and can tap that for higher down payments that can lower monthly payments. Home sales in August dropped 0.2% from July, up 1.8% from a year earlier; sales at $1 million or above were up 8.4% from a year ago. A house selling for at least $1 million in August spent 27 days on the market, just three days longer than homes in the $250,000 to $500,000 range — the price most of the country’s homes sell for.

Just Because

Tourists are flocking to the space age Chinese megacity of Chongqing, according to the Wall Street Journal, (paywalled), largely driven by influencers like native son Ryan Chen, who does a spot-on Trump impression while slurping a spicy hot pot. Jackson Lu, another local, has a video of a spiraling bus ride on a 20-story-tall elevated highway with 56 million views across TikTok and Instagram. The world’s most populous city, with 32 million people in an area the size of South Carolina, drew 120 million overnight visitors last year, up 17% from 2023. They came to see an elevated train that bisects a residential high-rise, a street-level plaza that is actually 22 stories up on the roof of a cliff-side building, and a neon skyline that lights up like a scene from “Blade Runner.” “It was just this feast for your eyes everywhere you turn,” said Bev Martin, a 62-year-old retiree from Florida.

Active Listings (National): ~1,100,407 homes (Sept 2025, not seasonally adjusted) (FRED) | More choice for buyers; pressure on older/overpriced listings |

Permits / Authorizations: 1,312,000 total units authorized in August 2025 (Census.gov). –3.7% MoM; single-family permits down 2.2% | Builders are losing confidence; pipeline for future starts is tightening |

Regional / State Inventory Revival: 12 states are back above pre-pandemic inventory levels (as of 2025) (ResiClub) | Some markets have overshot, turning from seller to balanced/ buyer conditions |

New Home Sales: 800,000 units (SAAR, Aug 2025). +20.5% MoM, +15.4% YoY | A strong rebound in new home segment, possibly driven by incentives or buyers shifting to new inventory |

Housing Starts: 1,307,000 units (SAAR, August 2025). –8.5% MoM, –6.0% YoY | New construction is weakening; builders are pulling back in face of macro and inventory headwinds |

Sales & Marketing roles:

Growth Marketing Associate, PetScreening, Mooresville, NC

Chief Marketing Officer, EliseAI, New York, NY

Senior Manager, Marketing Analytics, Hippo Insurance, San Francisco, CA

Product & Engineering roles:

Senior Software Engineer, Corporate Engineering and IT Security, Open Door, San Francisco

Senior Data Scientist, Compass, New York, NY

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}