Priced Out: The Escalating Crisis of Rental Affordability

The United States is at an inflection point with housing affordability, with over 50% of renters cost-burdened by growing rents as of 2022. With average incomes near all time highs and a softening jobs market, it appears at the surface there is very little slack in the line.

The current U.S unemployment rate is around 3.8%, with approximately 6.2 million people unemployed. If unemployment were to increase to 5.8%, the historical average, the number of unemployed would rise to about 9.88 million, adding over 3.6 million people to the sidelines and propelling this growing concern to a full blown crisis.

A Historical Perspective

Historically, rental affordability in the U.S. was more aligned with incomes, with less than a quarter of renters considered cost-burdened in the 1960s. However, the trend began to shift unfavorably in the 1970s because of economic recession and inflation, significantly outpacing income growth. The affordability crisis has been exacerbated by periods of economic turmoil, particularly during the Great Recession and the recent pandemic, which saw renter incomes stagnate or fall while rental prices surged.

According to the Harvard Joint Center for Housing Studies, the gap between income growth and rental costs has dramatically widened, with the 2020s witnessing a steep rise in the number of cost-burdened renters.

The Stress Test for Landlords

The reality of this convergence between historical low unemployment, historically high rental housing affordability, and the tightrope economy we are balancing is that even moderate stress can lead to meaningful challenges for landlords. If you haven’t gone through turbulent economic times before (looking at you, investors making their first acquisitions >2012) it’s time to manage your bottom line and reserves to the extreme.

→ Build to 6 months cash reserves minimum.

→ Review asset performance across your portfolio for underperformance.

→ Consider selling some assets if the idea of having six months per door in cash reserves is too much.

Read more about the ongoing affordability crisis here → Harvard University JCHS

The Potential Surge in Accidental Landlords

The concept of homeowners renting out their primary residence after they move is not new, but there is anecdotal evidence that this investor class of so-called “accidental landlords” is growing. Greg Schwartz, founder of the real estate listing website Tomo, said 15% to 20% of homeowners who buy a new home in the Dallas market choose to keep their old one to rent.

The notion that real estate can be part of a wealth-building portfolio over time has become a mainstream choice for retail investors (most of America). Given recent macroeconomic shifts in the housing market, the implications of this trend for financial planners and the real estate industry suggests an intriguing opportunity.

Motivations of Accidental Landlords

So, what exactly is an accidental landlord? These are property owners who mostly lived in their homes, not thinking of generating income, but now see that as an opportunity. The most common scenarios include:

→ Outgrowing a primary residence and choosing to rent it out vs selling

→ Relocating and opting to rent a former primary residence vs selling

→ Property owners who have a low mortgage rate and are reluctant to sell and lose access to cheap financing

→ Inheriting a property

The common thread is that the property was not purchased with the intention of turning it into a rental. For property managers and investment brokerage professionals, this trend augurs an increase in their potential market. So what’s driving this increase in accidental landlords?

The Favorable Economics

The advantages of real estate investment are straightforward. Principal, interest, property tax, insurance (collectively known as PITI), maintenance, and potential vacancies, are the carry costs for an investor. If rental income covers these costs, the property pays for itself while the owner benefits from long-term home price appreciation and builds equity. If rent exceeds these expenses, the investor also reaps cash flow. Couple these benefits with depreciation and other tax advantages, and real estate offers a compelling asset in an investor's portfolio.

Looking at the data from 2012-2023, according to Statista, the median price of single-family homes in the U.S. increased nearly 8 percent a year (from $187,400 to $389,300) significantly outstripping the national average increase of 4.9 percent from 1987-2023, according to Case-Schiller. (Some markets, such as Austin, Phoenix, and Atlanta, saw even bigger runups.)

Meanwhile, the average rent increase since 2012 has been 3.18%, but that growth has outpaced the average annual wage inflation by 270% and currency inflation by 40.7%. And rent increases on the coasts and other superstar metro areas have been higher.

Consider this example: A home purchased in Austin, Texas, for $250,000 in 2012 would get about $1,500 a month in rent. This year, the median home price in the Austin metro is about $430,000 — well off the peak of $555,000 in April of 2022 — and the median rent for a home is about $2,250 a month.

The options include:

Sell and decide on the next investment for the proceeds.

Rent it out, assuming you can afford a new home with other savings.

Stay and continue to pay down your mortgage.

Most Americans, unable to afford multiple properties, either opt to sell and upgrade their primary residence or stay put to maintain lower monthly expenses. For those able to either sell for a profit or convert their property into a rental, the choices become particularly intriguing.

Decide to sell - List the home for $450,000, for a profit just under the $200,000. avoiding the threshold for capital gains taxes. Assuming there’s a 5% sales charge, and another 2-5% in closing costs, there is about $180,000 left to put into a new property (or properties).

Decide to rent - The home rents for around $2,500 in 2024. For simplicity, we are factoring in baseline insurance costs ($1,500 a year), and a trailing property tax rate of 70% market value using 3% (Texas property taxes are high). A refinance in 2020 would peg the current fixed P&I (principle and interest) at $856 ($10,272 annually). All in, carry costs before vacancy and maintenance provisions of 10% works out to $1,027. On the expected rent of $2,500, there is $1,644 ($19,728 annually) in gross profit of which about $4,000 should be set aside for unexpected repairs. There is now $226,000 in equity in an asset that is considered one of the best hedges against inflation and offers a passive income stream of $788 a month.

What would you do?

Where We Think This Goes

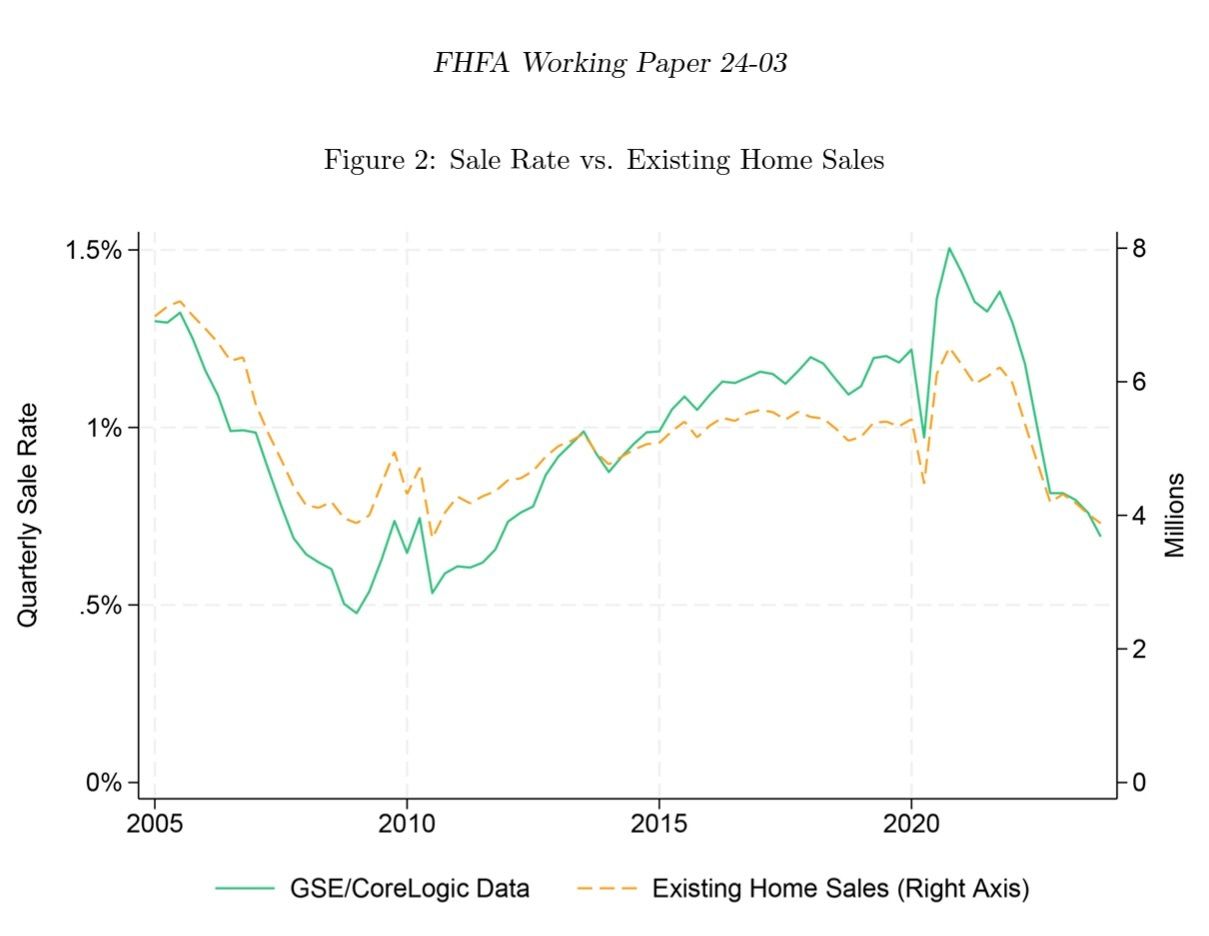

The unique combination of low prices after the 2008 housing market crash, followed by a prolonged low-interest rate environment (with historically low sub-3% rates in 2020-21) helped feed a spike in prices during the pandemic and created an unprecedented real estate environment. According to a working paper from the Federal Housing Finance Agency, these low “mortgage lock-in rates” kept some 1.3 million homes off the market from the middle of 2022 to the end of 2023.

The 80% of American homeowners who now have a sub-4% fixed-rate mortgage are increasingly reluctant to upsize or downsize if it means taking on a mortgage rate over 7 percent. The upshot is that inventory shortages will likely continue, supporting higher rents and property values.

Our analysis, based on anecdotal evidence and polling from Gallup that shows 34% of Americans said last year that real estate was the best long-term investment, suggests that up to 20% of homes not on the market could be redirected towards rentals, increasing the number of single-family rental properties from its current 20.1 million. How many of those 1.3 million homeowners the FHFA identified who decided not to sell in 2022-23 will decide to become landlords? Hard to say, but certainly more than a few.

Much is made of targeted buying of single-family rentals by large investors, but research by Brookings puts the percentage of units owned by the Blackstones of the world at just 3%. Blackstone is the biggest buyer of single family houses, with some $2.5 billion totaling up to 16,000 single-family houses. There are 82 million homes in the U.S. Institutional investors have a bigger share of some markets, such as Atlanta, Birmingham, Charlotte, Indianapolis, Jacksonville, Phoenix, and Tampa.

But we think the number of real estate investors owning between 1-9 units could increase significantly in the next couple of years, though it’s difficult to quantify.

As the landscape evolves, more targeted research is needed to quantify this market's growth. Property managers and the brokers serving investors are particularly keen on understanding these dynamics, as they reveal potential trends in investment behavior. We are committed to delving deeper into this topic in upcoming issues.

Chattanooga, Tennessee

Chattanooga has been revitalized in recent years, particularly the downtown and historic districts, enhancing property values and attracting investors seeking properties in up-and-coming neighborhoods. Chattanooga is more affordable than most major cities, and its startup ecosystem and well-developed infrastructure, coupled with migration trends, combine to create a housing market with strong potential returns on investment.

Migration South Powering Population

→ Chattanooga’s population of 186,000 (or about 528,000 in the greater MSA) is growing at almost 0.7 percent a year, nearly twice the rate of the U.S.

→ Retirees souring on Florida, it’s become a retirement destination

→ The city’s investment in high-speed internet attracts startups & VCs.

→ Chattanooga is affordable, with an average home priced at $300,140 (vs. Nashville’s $439,470) lures families priced out of other metros.

The Next Austin, TX?

For some, the city reminds them of a boomtown about 1,000 miles to the southwest. “People come here and are like, ‘This reminds me of Austin 20 years ago,’” Tim Kelly, the mayor of Chattanooga, told the Wall Street Journal.

Kelly, who is an Independent, said the story of his city is one of renewal, “transforming itself from a small, polluted trading post on the Tennessee River into a thriving city recognised around the globe.”

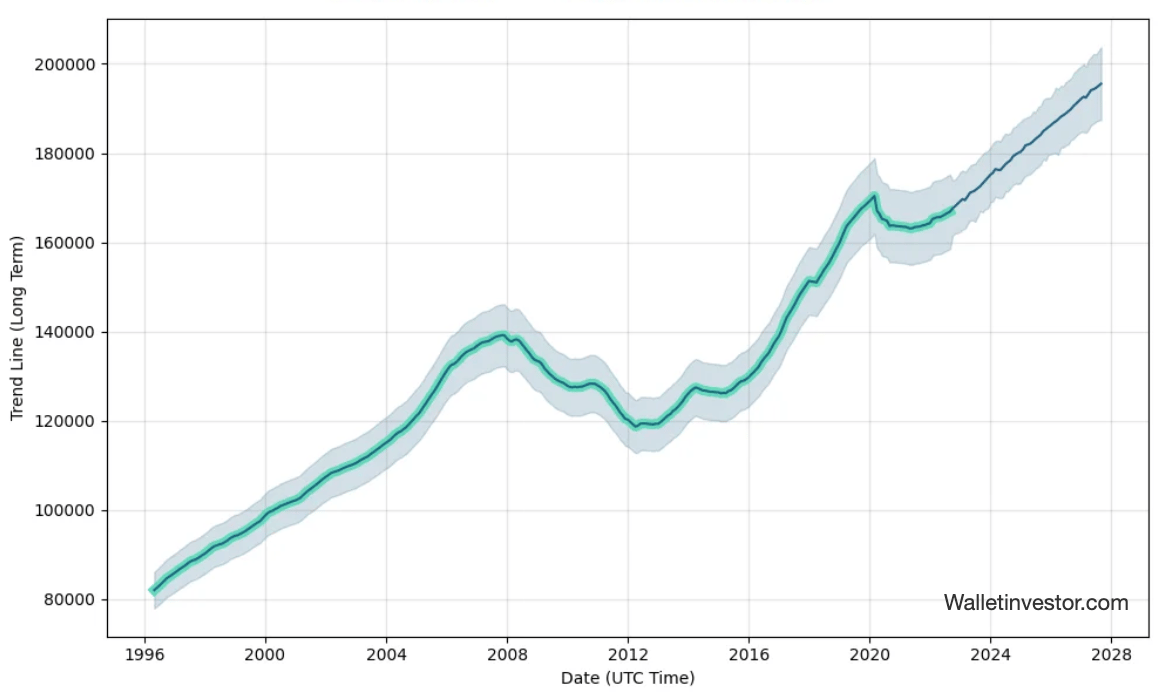

Price Appreciation

1911 Citico Ave

This modern three-bedroom, two-bathroom home exudes elegance and sophistication. Its sleek design offers a perfect balance of style and comfort. Inside, hardwood floors create a warm and inviting ambiance throughout the living spaces. The kitchen is both stylish and functional, boasting quartz countertops and a suite of Stainless Steel Appliances, perfect for meal preparation and casual gatherings. The bathrooms are luxurious retreats, featuring tile showers that elevate your future resident’s daily routine.

The Investment Thesis

With focus on long term rental, this house, located less than 7 mins drive away from Chattanooga’s startup VC Brickyard and close to a line of breweries. Over 20 years, this asset will benefit from the tax advantages and cost segregation now with price appreciation in the years to come. An estimated 11.96% IRR over the course of the next 20 years

→ Population growth double that of the US

→ High speed internet investments across the city

→ Startup ecosystem is small but growing (See Brickyard)

Property Details

Yr Built: 2024 | Type: SFR |

Sqft: 1,285 | Bed/Bath: 3 , 2 |

Financial Projections

Asking Price: $329,500 | 5 Yr Appreciation: $81,116* |

Rent: $2,250 | Annual Gross Income: $27,000 |

Interested in Learning More?

*Appreciation based on 4.5% growth rate.

Empowering Consumers: Zillow Past and Present 🏠

The National Association of Realtors (NAR) decision to pay $418 million and eliminate its rules on commissions to settle a series of lawsuits is poised to shake up the real estate brokerage industry. The agreement challenges the traditional structure of sales commissions, which are often misunderstood as being fixed at 5 or 6 percent, to be paid by the seller. These fees totaled some $100 billion annually in the United States. Now, negotiations on listing fees and changes in how buyers compensate their agents are expected to save homeowners money.

Rich Barton, CEO of Zillow, has advocated for transparency, fairness, and access to information. In a recent LinkedIn post, Barton outlines the guiding principles that drive Zillow's service offerings, ensuring that consumer interests are at the forefront of their business model.

Zillow’s Wins: Enhancing Consumer Experience and Choice ✨

→ Single search experience revolutionizes the way consumers access listing information by consolidating data into a single, user-friendly platform. The NAR had positioned licensed realtors as gatekeepers, which promoted information asymmetry and gave the brokers the upper hand.

→ Zestimate provided a free, large-scale automated valuation model (AVM) for single-family homes. While it has limitations and doesn't replace a professional comparative market analysis (CMA), it’s a valuable tool for consumers seeking quick home value estimates, reducing the information asymmetry that tilted the playing field against homeowners.

→ Consumer choice is fundamental to Zillow’s ethos, bolstered by its extensive network of third-party agent referral partners. This not only diversifies options for consumers but also underscores their role in the advertising domain, distinguishing it from other real estate businesses.

Zillow’s Next Challenge: Navigating Competitive Waters 🌊

The primary challenge for Zillow lies in balancing its primary revenue generating product (Premier Agent) with the inevitable move toward direct transaction. As competitors like Opendoor streamline the buying and selling process through technology, Zillow must innovate to compete. Insights from Zillow's quarterly earnings calls reveal an aggressive strategy for integrating new products and services through their “housing super app,” inching closer to direct transaction engagement — a shift that could conflict with their business model of selling leads to agents.

As the real estate market evolves, Zillow finds itself at a crossroads, needing to serve increasingly divergent interests within its marketplace. The challenge for Rich Barton and his team is clear after the NAR settlement, and delivering on their commitment to consumers requires some nimbleness from one of the industry’s giants.

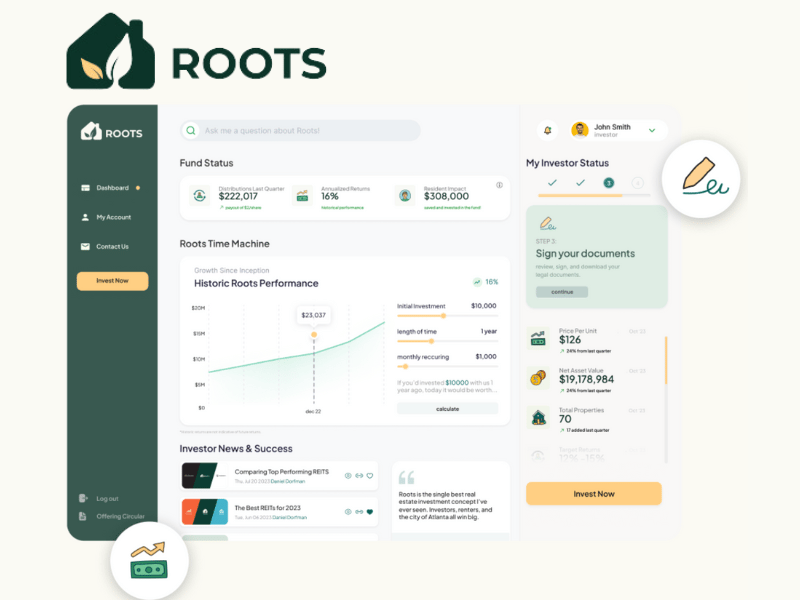

Roots

Roots is a Regulation A+ real estate investment trust (REIT) with annualized returns of 16% since its launch in 2021. The Atlanta-based company set itself apart by allowing renters to qualify for fund investments by paying rent on time and taking care of the property. As of late April 2024, this approach enabled renters to save and invest more than $465,000, offering a meaningful return on investment for investors and renters alike.

Roots aims to do more than generate wealth; it is designed to create a sustainable community where economic opportunities are available to a wider audience.

The Origin Story 🌱

“After spending over a decade in real estate investment, leading syndicates and facilitating countless transactions, the pandemic gave me a chance to reflect,” said Roots co-founder Daniel Dorfman. “I realized that true success in real estate hinges on the people who call these properties home. After all, they are the ones paying your bills and taking care of your property.”

Dorfman saw an opportunity to link the interest of owners with renters.

“Instead of alienating renters, I wanted to empower them as partners to share in our success,” he said. “My vision? To democratize real estate wealth creation by inviting everyone to invest and incentivizing renters to contribute to property upkeep and growth, without bearing upfront costs.

Investment as a Community Bridge ✨

Roots operates on the principle that investing in workforce housing benefits both investors and the renters. This model allows renters to build savings through incentives throughout their tenancy, addressing the increasing challenge of housing affordability, where rents are eating up almost half of household incomes in many areas today. (Well beyond the recommended 30 percent of income going to housing costs.)

Roots allows renters to invest their security deposits in the fund. They also receive financial rewards for timely payments, allowing property inspections, and keeping their homes in good condition. These incentives are given in the form of fund shares, which can be cashed out when they move. Many renters accumulate a meaningful amount, sometimes enough for a down payment on a future home. The average resident account balance is over $2,800 at move out.

The Roots Difference: Shared Success 🤝

Roots offers clear benefits to both investors and renters:

Investors

✓ 16% annualized return*

✓ Fractional, starting from $100 with no accreditation required

✓ Benefits of real estate without the maintenance responsibilities

✓ Diversified portfolio with residential real estate assets

✓No early redemption penalties after year one

Renters

✓ Start earning day one

✓ Fair market-rate rent while building savings

✓ Potential to earn up to $150 per quarter from performance incentives

✓ Renovated, well maintained homes with local management

✓ Potential to save an estimated $2,000 over a two-year lease

A Future Rooted in Shared Prosperity

Roots is dedicated to cultivating a future where investment is synonymous with positive change. Their commitment to shared prosperity is reflected in every project they undertake, aiming to create economic value while leaving a lasting impact on communities and the environment. By joining Roots, investors become part of a movement aimed at fostering a more equitable and sustainable Atlanta. The company plans to expand into more key metros soon.

If this sounds like you, join over 5,000 others investing with Roots today.

For professionals in the industry interested in learning how they can leverage technology to offer similar benefits to their customers, connect with Roots partner Benjamin Turner for more information.

Disclosure: prop.text was not paid for this piece.

*stated returns from investwithroots.com. See website for more details.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}

Buy prop.text Swag 🛒

You can buy your own prop.text merchandise

Coming Soon

100% of the proceeds go toward making this the best real estate investment newsletter for our valued readers.