Roofstock & Mynd: The Merger the Industry Expected

This one is personal. For those unaware, the team behind this newsletter came together through our mutual admiration and friendship formed while scaling Mynd. We are a writer/editor, a marketing whiz, and a seller, all with personal real estate investment experience and a shared passion for spreading the message to others. Our friendship has left an indelible mark on my experience as a Mynder.

The Early Days

My proptech journey started as part of a team at HomeUnion, a real estate investment platform that had been competing with Roofstock for individual investors since 2015. We operated as a transactional-based IaaS (Investment as a Service) business, swiftly progressing from seed through Series B funding. However, by 2018, we began experiencing headwinds as interest rates for investment properties passed 5.5% for the first time in over a decade and investor appetite cooled. We started exploring pivots and exits. During this process, we launched a B2B SaaS platform called InvestimateROI, white-labeling property manager portals to enable real estate investing at scale without upfront sunk costs. We onboarded some of the best property managers across the country, including Mynd.

As our relationship with Mynd evolved, we discovered a mutually beneficial outcome. Mynd aimed to become a full-service investment operator by 2023-24 after mastering property management at scale. Our technology and talent could help them leap forward when the timing was right. We finalized a deal in mid 2019 and were acquired shortly after Mynd's largest property management acquisitions, Empire Industries and RentVest.

What Happened Next

This was my first career experience with a roll-up strategy. In 2019, Mynd was acquiring bulk property management doors in markets that aligned with their long-term growth footprint. However, we quickly learned that the industry operated differently in many areas. This reminded me of why wealth managers are so intentional about vetting when they acquire books of business. If your specialty is 401k administration and you acquire a day trader’s book, you’ll face misalignment and churn. The same was true with property management.

The Empire portfolio consisted of yield-hungry investors targeting the best of the lowest-priced homes, mostly in Houston. This client base required a much higher level of customer support compared to the RentVest book of business, which was largely made up of accidental or small investors in growing markets like Phoenix and Reno. Some property manager acquisitions were excellent, while others were unwound. The leadership team realized that building a retail customer base from scratch that fit the Mynd model would be far more successful long-term than relying on M&A.

The Pandemic Changed Everything

Fast forward six months, and the entire country was in lockdown. Mynd had just raised a $41.5 million dollar Series C round, a monumental feat given the circumstances. Despite this achievement, uncertainty loomed, and in the best interests of the company and its runway, Mynd opted for a significant reduction in force (RIF) mid-2020 that impacted every function of the organization.

This period also marked another shift in strategy. The goal was to pivot our go-to-market approach to digital marketing, target specific ideal customer profiles (ICPs), scale retail customers, build the backbone for institutional servicing, and charge forward for the next stage of growth. The leadership team brought in new executive talent and realigned the organization.

The juxtaposition between a cautious 2020 and a euphoric 2021 was a wild ride. Our institutional group, led by David Zanaty, began delivering results that far exceeded projections. The team was so dialed in that we landed a multi-billion dollar deal with Invesco to acquire and manage homes, nearly another $100M in equity financing between Invesco and QED, and accelerated the entire repositioning of the company from a scaled property management provider to the premier full-service real estate investment platform for both retail and institutional clients. We experienced 50%+ quarterly growth, forced every revenue line to re-forecast as we outpaced our plan, and embraced growth at all costs. Our marketing budget increased twelvefold, sales org headcount quintupled, new functions were formed to accelerate the tech roadmap, and our post-money value tripled in 10 months to more than $800 million dollars.

Growth at all Costs is Expensive

Mynd would face an organization-wide crossroads between balancing growth and service in 2022. The team was so focused on top-line door growth that we were slow to address the issues hiding in plain sight.

Churn was a major problem. It exceeded an industry average that was already unacceptable compared to other service industries. Property management is thankless and getting it right is hard. These days the industry is moving toward providing more value for a fair cost versus a race to the bottom on pricing that isn’t sustainable for anyone.

We lacked focus. We were trying to grow retail investors while also scaling our institutional servicing. I’ll ask you, reader: if I were to give you a multi-billion dollar mandate to buy rentals all cash within a specific buy box, or to service individual investors who buy 98% of the time financed, within the same buy box, what would you do? We opted to prioritize both, which handcuffed our retail buying efforts. The notion that you can do both is not true when the targeted assets are exactly the same. We tried pivoting to almost exclusively new construction to resolve this conflict, but it ultimately led to more issues out of our control.

Growth outpaced support. Yes, growth can be a problem if a company cannot support it. We were growing like crazy. The revenue team, coupled with excellent branding, countless micro-experiments, and honing our go-to-market, created a monster. We signed nearly 500 doors per month, but this growth overwhelmed our front-line operations team. They were being set up to fail, and our employee attrition rates for this group were untenable. We built a system that theoretically worked better than any other third-party option in the market, but in practical terms, it wasn’t enough to support the outsized workload. Some controls put in place to measure effectiveness were easily gamed. We also gave ourselves too much credit on the tech side of things. None of the tech was all that transformational and would be best described as a more complete version of a task/ticketing platform. It still took people to do the work.

Gross margin posed a predicament. Venture capital requires a high gross margin because it’s one of the only ways to hyper-scale enterprise value with the least amount of headcount. This is why software companies work well in the venture ecosystem; marginal costs are nearly zero. Tech-enabled real estate services companies, not so much.

We had strategy meetings about bringing maintenance in-house, adding property management support, and increasing headcount for customer success, but most of these ideas were met with the dreaded margin problem. As we grew, there was no way to maintain service levels without adding more people. It is what it is. Anyone telling you they can manage your home well purely with technology is lying. It cannot be done well today. Maybe large language models and trade service platforms can bridge the margin gap and make it more efficient, but it’s a people business.

What’s Next?

The deal between Roofstock and Mynd is the best possible outcome, a marriage of two industry leaders striving to survive for the next growth cycle. Mynd was not going to make it on its own and would have likely faced an Invesco takeover or dissolution, despite making significant improvements to the property management business over the past two years.

Roofstock wasn’t in a much stronger position. They raised an opportunistic round in early 2022, filling their balance sheet with cash, while watching their acquisitions revenue sources dry up. By adding Mynd, they get an influx of millions in recurring revenue to offset lost Streetlane Homes doors and can de-risk bulk property management churn with the blended retail/institutional book that Mynd manages.

Now, they have a full-service institutional SFR platform with plenty of cash in the bank. All that’s left is to stay focused and execute.

For me, this marks the end of one of my favorite chapters of my career. Helping people from all over invest in real estate at scale was an almost unhealthy pursuit for some years.

Looking back, I find myself asking two questions repeatedly:

Does retail real estate investment management scale? For me, the answer is no. The level of service required at the individual level for personal assets is too noisy for nationwide operators. It’s better to build your own team.

Is SFR as an asset class good for America? I’m not so sure. It changed my life, and I’ll continue to be involved in some form for the rest of my career. However, it’s clear to me now that most of the money in SFR flows to the lower end of the most desirable, up-and-coming markets, crowding out some families looking for their first primary home purchase. This will eventually come at a cost, as primary homes are the largest source of generational wealth for middle-class families. If there are no starter homes to help them take that first step, even more families will be left behind in the race for upward mobility.

Until next time,

Thomas | ex-Mynd

The Best Time to Buy Real Estate? Now, or ASAP

In life, we often hear the line “it’s about all about timing.” Or “it’s all about timing, and luck.”

Well, most people make their own luck and life, and timing is a tricky game.

With interest rates pushing past 7 percent, a lot of the chatter about real estate these days is that it’s not a good time to buy. The New York Times has a rent vs. buying calculator that advises folks to rent in the current market as it is cheaper than buying.

So when is a good time to buy, for current real estate investors and those thinking of jumping in?

How about now? Or as soon as you can?

Much as it’s a fool’s errand to time the stock market — a report from S&P Dow Jones Indices showed that over a 20-year period ending in 2023, fewer than 10 percent of actively managed U.S. stock funds managed to beat the index — we don’t think it’s possible to “time” the real estate market, despite the claim made by Craig Hall’s 2004 book “Timing the Real Estate Market.”

Most smart stock investors practice dollar cost averaging, investing a fixed amount of money in an index fund, exchange traded or mutual fund monthly on a regular basis. They end up buying through market dips and highs and build a portfolio that increases in value over time.

Real estate operates pretty much the same way. Over the long term, home values go up, and along the way investors benefit from tax advantages, depreciation, and build equity in real property.

Of course buying at a market peak can be brutal. And there are plenty of folks who lost it all during the housing market crash in 2008-09. But there are plenty of folks who made big money shorting that market (see proptext, issue #3, Don Mullen) and then decided to get into single family residential (SFR) when the dust settled. (Rents actually went up in some cities in 2008-09, and some folks did manage to weather the storm.)

We hope you enjoyed the musical interlude. Don’t ever say proptext is not a multimedia experience.

In retrospect, of course, the housing market crash of the late 2000s turned out to be one of the best times in the last century to be buying homes, and those who had the nerve to do so made out very well.

One of those buyers was Doug Brien, until about a week ago the CEO of Mynd, where the editors of proptext spent some time drinking the Kool-Aid. Brien started buying in 2008 and by the time his company Waypoint merged with Starwood and rang the bell on the trading floor of the NYSE in 2014, they had 17,000 homes in their portfolio. Brien went on to start Mynd in 2016, which somehow birthed proptext. We’ll tell that story at another time.

So timing the real estate market ... Don’t bother trying. Nobody predicted the runup in prices when the pandemic hit, but here we are with homes in some markets now selling for double of what they were on the market for in 2019. Forget it. You missed out. That ship has sailed. (Mynd recently merged with Roofstock, and Brien is now the president there.)

Dani Pascarella, CFP, founder and CEO of OneEleven, a financial planning company, has this advice for those who think they can time the stock market.

“The more you pay attention to business news headlines and your account balance, the more likely you are to act on emotion,” Pascarella told Bankrate. “Turn off the TV and check your accounts on a less frequent cycle, like once per month. Educating yourself on investing and economic cycles will also help you to feel confident about your investments and ignore all of the noise.”

“The problem with [trying to time the market] is that identifying the perfect time is nearly impossible and the perfect time may never arrive,” Pascarella says.

That advice applies to real estate as well. Think of real estate as a get rich slow scheme. Buy and hold, like Warren Buffett advises: “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

Of course Buffett does buy and sell some stocks, and not every real estate deal belongs in a portfolio forever.

Downside Risks of Real Estate

The lessons for investing are simple: Do your homework. Hustle. The SFR market is huge and inefficiencies exist, and the process of underwriting a home should reveal if an investment will work, both short and long term. There is a reason the so-called smart money, the Blackstones and the Pretiums of the world, have been buying in the SFR space for the last decade, which is about the amount of time it’s existed as an asset class.

There are plenty of things that can sabotage the best-laid real estate investment plans. These include:

Problem tenants

Volatility in the real estate market (we’re talking about you, Miami, Phoenix, Atlanta, Houston and other so-called “hot” markets.)

Vacancy periods

Underestimating the cost of repairs and maintenance

Lack of liquidity

But over time, real estate holds its value, is a tangible asset that can weather inflationary periods, and it provides tax benefits. Housing prices have stayed high, even post-pandemic, because of the laws of supply and demand. There is some disagreement on how many millions of homes the country is short, as the Joint Center for Housing Studies at Harvard University points out, but the US housing market is chronically underbuilt (this is in part a hangover from the 2008-09 crash). Freddie Mac puts the figure at 3.8 million, while the National Association of Realtors estimates it is 5.5 million units.

So buying an investment property right now might seem like bad timing, but what is a good time? Does Craig Hall’s book offer the definitive answer on when to buy? Not likely, though there is some sound advice in there.

And what about diversifying a portfolio? International stocks, emerging markets, US equities and bonds, we got bad news for you, is not a diversified portfolio. Real estate is a start. As for rate of return, the San Francisco Fed measured that for various asset classes from 1870-2015 and found: In terms of total returns, residential real estate and equities have shown very similar and high real total gains, on average about 7% per year.

The time to buy is when the investor is ready. A buyer today, with a 30-year fixed loan rate of 7 percent, will own about 15% of the home in May of 2034. If that loan is refinanced at 5% when/if mortgage rates come down, it will bump up a couple percentage points. As the home value appreciates — which we expect homes to do — the equity stake will increase as well. (At a modest 3% increase a year, the home value would pop about 35% in a decade.) Meanwhile, each year the investor will reap the tax advantages of owning property.

So what are you waiting for?

Columbus, Georgia

A charming Southern city along the banks of the Chattahoochee River, and a hidden gem for savvy hospitality investors looking to capitalize on the flourishing Airbnb market.

With its rich history, vibrant cultural scene, and strategic location, Columbus offers a blend of attractions that appeal to travelers seeking authentic experiences and memorable stays.

Historic Charm and Cultural Attractions

→ National Civil War Naval Museum

→ Meticulously preserved antebellum homes

→ Fort Benning, one of the largest military installations in the United States

→ Idyllic location along the Chattahoochee River

→ Close to both Atlanta and Birmingham for short weekend stays

Investment Potential and Returns

As it was recently named the #1 market for investing by Airdna, Columbus presents a lucrative opportunity for investors who see opportunities in the Airbnb market. The city's affordable real estate, coupled with strong occupancy rates and competitive rental yields, make it an attractive investment destination for those seeking to generate passive income and maximize returns.

4 Milton Ct

This 4-bedroom, 2-story home is situated on a spacious cul-de-sac lot in the sought-after Brookstone neighborhood. The welcoming foyer opens to a large family room with a fireplace, a formal dining room, and a bright, updated kitchen featuring a casual dining area, island, and walk-in pantry. The main floor also includes a guest suite and a full bathroom.

Upstairs, the primary suite offers double vanities and walk-in closets. Two additional bedrooms, a full bath, and a spacious laundry room complete the second floor.

Enjoy the private screened porch, expansive rear lawn, and wooded views. Additional features include a fenced area for dogs, a 2-car garage, and a parking pad.

The Investment Thesis

→ Driving destination for both Atlanta and Birmingham

→ Largest military base means demand for short-term/mid-term rentals

→ Affordable homes and a large amount of inventory means negotiation leverage for a deal

Property Details

Yr Built: 1983 | Type: STR |

Sqft: 2,583 | Bed/Bath: 4 , 3 |

Financial Projections

Asking Price: $335,000 | 5 Yr Appreciation: $34,867.07* |

Revenue: $43.1K | Annual Gross Income: $3,733/yr |

Interested in Learning More?

*Appreciation based on 2.0% growth rate.

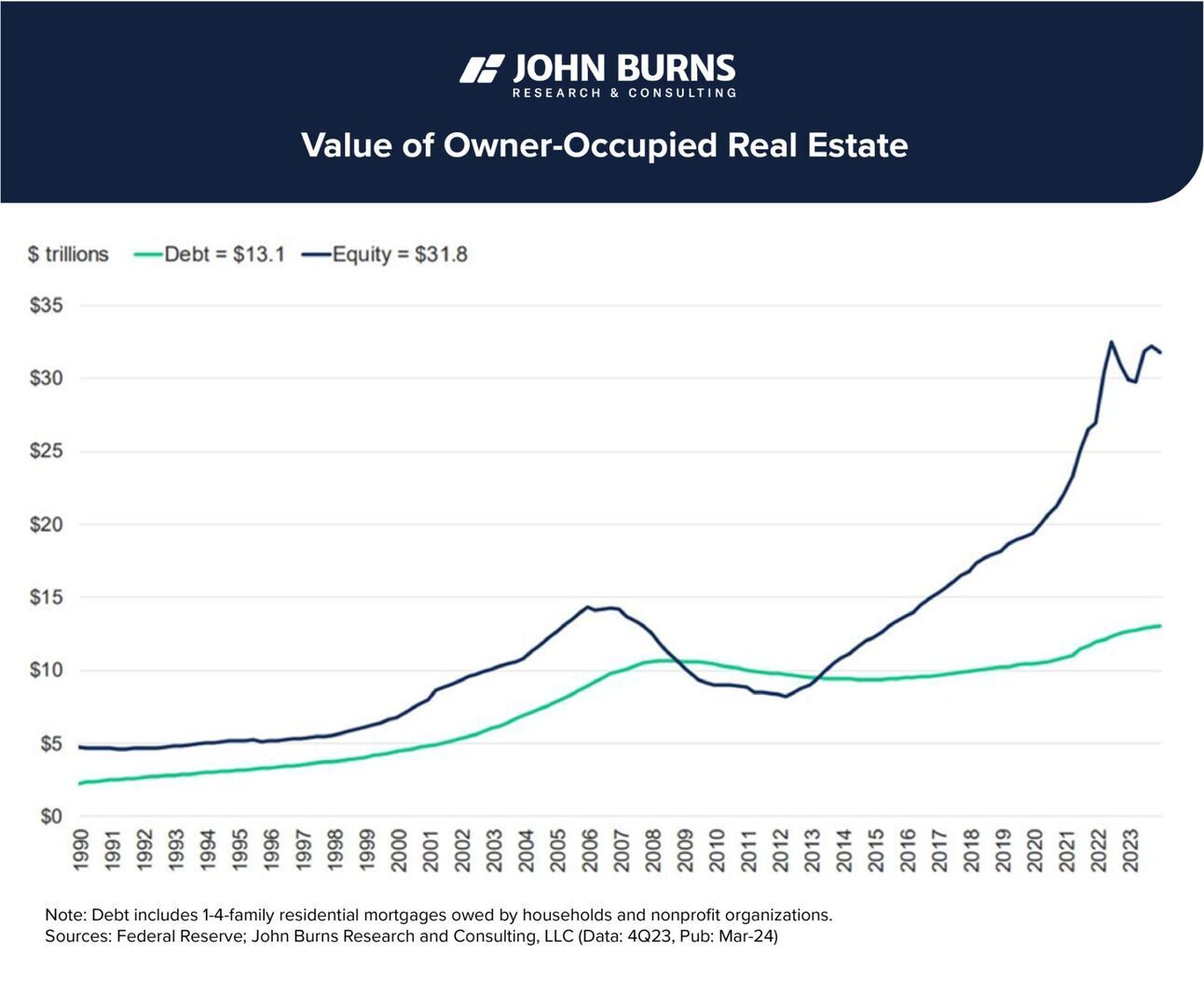

A Mountain of Home Equity

Homeowners are sitting on nearly $32 trillion in home equity, according to Sean Wong of John Burns Research and Consulting. This is more than double the $15 trillion peak in 2006, which was the byproduct of the most fraudulent housing market in American history.

So, what does this mean? According to Mr. Wong, there are three ways this equity avalanche will be utilized:

Down Payment Support: Homeowners with significant equity might help their children with down payments to buy their own homes.

Trade Up: By selling at the peak, homeowners can realize gains and use the funds to make larger down payments on their next home.

Repairs & Remodeling: Tapping into home equity allows homeowners to cost-effectively improve their properties, employing local tradespeople and boosting the economy.

Our Thoughts

Are we sure we are not in a bubble?!

Did the Fed break housing with a decade of artificially low interest rates (quantitative easing) followed by the zero interest rate policy (ZIRP) of the Covid era?!

It’s hard to believe we’d see a chart that makes the run up of the early 2000’s look like a small growth pocket, but here we are.

Wong’s points make sense, though trading up is less likely given the added expense from higher interest rates. One trend worth paying attention to is the decline in remodeling. Even though there appears to be plenty of equity to be tapped for renovations, the amount spent on remodeling is declining quarter over quarter. This suggests either those who could have remodeled already have, or households are under added financial stress and don’t want to add more to their monthly debts.

To read the original post from Sean Wong on Linkedin, click here. Make sure to follow both Sean and John Burns Research and Consulting for more timely insights on the current state of the single-family home industry.

Finresi

In today's yield-challenged real estate market, Finresi stands out by advertising 10-12% returns* through investments backed by prime properties from Los Angeles to Miami. The company is a pioneer in the first nationwide private debt marketplace for individual assets, empowering investors to discover, analyze, and fractionally invest in top-tier bridge loans.

Investors can build a diversified portfolio of private debt investments in familiar, high-growth markets, with average maturities of just 7-12 months. Let’s dive into the founders’ journey to learn why this platform, combined with the team's collective industry experience, offers a way to diversify your returns.

How They Started

Finresi was conceived in 2022 by Jeff Gophstein, founder and CEO, at the Entrepreneurs Roundtable Accelerator (ERA) in New York City. The initial goal was to create a marketing platform connecting real estate investors with investment properties, lenders, and other service providers, capturing referral fees throughout the process. Increases in interest rates made fundraising for this model challenging, as many VCs expressed concerns about investors' reluctance to buy homes in such an environment.

A few months later, Jeff reconnected with Kirk Ayzenberg, co-founder of Finresi and CEO of Nextres, a nationwide hard money lender with over $100 million in annual originations. This meeting sparked the concept of a private debt marketplace, where everyday investors unfamiliar with the space could earn substantial short-term returns that were backed by real estate assets.

Jeff explained: “Interest rates skyrocketed, we couldn’t land funding, and after speaking with Kirk, the path forward became very clear. Combining my acquisitions background with Kirk's expertise in private debt meant that Finresi could offer a platform featuring assets that exceed those available through our competitors in both quality and return.”

Why Finresi Makes Sense Right Now

The real estate investment market has changed considerably over the past four years, from a pandemic-induced zero interest rate policy (ZIRP) to the largest twelve-month benchmark interest rate increase in forty years.

One way to gauge risk appetite is by comparing asset classes to the risk-free rate of return — what an investor can earn with zero risk. In practice, most use the 10-year treasury as this benchmark, which traded around 4.43% this month.

The single-family home investor must weigh future returns against what parking money in the 10-year treasury will earn, and determine if the risk of owning real estate is fairly priced.

The average cap rate of a single-family home nationwide is 5% today. Assuming an additional 3% for appreciation, which may be challenging given current market dynamics, that yields 8% yield. However, seasoned real estate investors know this game is not linear. Portfolios experience periods of exceptional performance, breakdowns, and everything in between. Is a 3.5% premium worth that risk?

Alternatively, the debt side of the single-family housing equation looks significantly better. There are shorter lockups, more liquidity, and meaningfully higher yields — up to 50% higher. In the worst case, principal is still backed by an asset with a maximum loan-to-value (LTV) of 65%. The market would have to pull back 35% before a break even point is hit, which has happened only twice in over 100 years: the Great Depression of the 1930a and the Great Recession of 2008. The probability of such a crash isn't zero, but it is highly improbable and potentially less risky than holding a long-term rental through a steep economic reset.

How Do I Get Started? ☎️

Investors are only a couple clicks from diversifying and generating meaningful returns in a whole new way with real estate investing. First, visit the Finresi marketplace and create an account. Then, verify the account, accreditation status, and select the projects you want to invest in.

If this is your first time investing in loans and you want more peace of mind about the process, team, and investments, you can schedule a free consultation with one of Finresi’s investor relations team members. They are licensed and trained experts specifically in this asset class, ready to help you make your first, or next investment.

*Visit finresi.com to review investment details.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}

Buy prop.text Swag 🛒

You can buy your own prop.text merchandise

Coming Soon

100% of the proceeds go toward making this the best real estate investment newsletter for our valued readers.