Pretium Keeps Growing. Is That a Problem for the Housing Market?

Don Mullen is the founder and C.E.O. of Pretium Partners LLC, a major player in the U.S. housing market with some 90,000 homes in their portfolio, with over half of the portfolio located in Florida, Texas, and Georgia.

This perch may surprise given Mullen’s initial foray into the U.S. housing market, where he placed the bet against the market that became known as the “Big Short,” which deployed collateralized debt obligations (essentially bundled debt sold to investors) that would pay off if housing prices fell and homeowners defaulted on their mortgages.

While an executive at Goldman Sachs, Mullen predicted a windfall because credit-rating companies had downgraded mortgage-related investments, which caused losses for investors.

“Sounds like we will make some serious money,” Mullen wrote in an email in 2007.

Goldman and its clients (including hedge-fund managers like John Paulson) avoided losses and made billions of dollars when the housing market collapsed, and thousands lost their homes to foreclosure.

Mullen must have liked what he saw in the late 2000s because he founded Pretium in 2012 and has been opportunistic ever since:

From 2013 to 2019, Pretium acquired more than 5,000 properties per year, according to SFR Analytics.

In 2021 and 2022, with the fund acquiring more than 12,500 home in each year, SFR Analytics reported

When Zillow exited the home-flipping business in late 2021, Pretium bought more than 3,200 of its properties.

It announced in February that it raised nearly $1 billion for a new fund to acquire rental homes from builders.

It also said in February that it has invested more than $2.5 billion to buy and develop purpose-built rental homes.

According to Bloomberg, one insider said Pretium was using the new fund to buy homes in its existing markets and can buy properties that aren’t immediately cash-flow positive.

That last bit of news is instructive, and is at the root of criticism of institutional buying in the Single-Family Residential (SFR) market. The argument goes that institutions like Pretium and other large buyers of homes like Blackstone, Invitation Homes, OpenDoor and Tricon are crowding out first-time homeowners and small investors because they have deep pockets and different economics.

The institutional SFR owners counter by saying that they only own about 3% of the 82 million single-family homes across the U.S. and the market functions just fine with them in it, adding they bring professional management and provide quality housing.

But the 3% number can be deceiving. In some markets, such as Atlanta, Jacksonville, Tampa, Phoenix and Houston, institutional investors are particularly active and own as much as 10% of the housing stock. In 48 zip codes in Atlanta, 5-13.8% of homes are owned by institutions, according to data compiled by Parcl Labs.

And this trend shows no sign of letting up. Core Logic reported that investors accounted for 27% of all single-family home purchases in May of 2023; in June, that number was 26%. A report from MetLife estimates that institutions will possess 40% of all SFRs — roughly 7.6 million homes — by 2030.

Not so long ago, many apartment buildings were owned by smaller operators. Now, at least 40 percent is owned by institutions, and few people are complaining about sending their rent check to a corporation.

But the idea of a “home” is different in the American mindset. It’s more emotional, more nostalgic, and not a bad way to pass on generational wealth.

The question is how all these factors will play out for the U.S. single family housing market. With median home prices hitting the high $300,000s, competition from institutions, student loan debt, and other barriers to the starter home market, the fate of the American dream of owning a home feels more elusive than ever.

Hurricane in Florida Keys 1935

Florida’s Troubled Insurance Market Has Bigger Problems Than Warming

Climate change is frequently cited as one of the leading causes of the collapse of Florida’s home insurance market. The specter of bigger and badder storms battering the state’s coast are making the economics of underwriting the properties along that coast a loser, the reasoning goes.

The insurance market in Florida, we believe, is one that was set up to fail, largely the result of overbuilding, rampant fraud, and criminal neglect in land-use planning. Also, the reality in Florida is the same as it is in other states where disasters strike — whether it’s flood, fire, wind, or other acts of God — replacement costs have skyrocketed.

Checking storm frequency reveals that the 1940s rank as the worst decade for hurricanes over the past century, with six making landfall across the state, four of them category 4. Apparently, Floridians were not on a first-name basis with their storms in the mid-20th century, as 5 of them went unnamed. (The 1940s were an active weather year across the U.S. with 24 total hurricanes, and 10 that were either category 3, 4, or 5 on record.)

That’s not to say that warmer waters and increased heat bode well for the future. Scientists from Rowan University in New Jersey found that Atlantic hurricanes are strengthening faster, going from Category 1 hurricane to a Category 3 more quickly today than they did decades ago. From 2001 through 2020, hurricane intensification rates were up to 28.7 percent greater than they were from 1971 through 1990.

But this does not explain why Florida Governor Governor Ron DeSantis signed several insurance reform bills during the 2022 and 2023 legislative sessions, which were aimed at stabilizing the state’s chaotic home insurance market.

Florida accounts for only 9 percent of the country’s home insurance claims but 79 percent of its home insurance lawsuits, many of them fraudulent.

Because of fraudulent lawsuits and the high overall claim risk in Florida, insurance companies faced losses over $1 billion in 2022-23.

Florida lost some form of home coverage from more than 30 providers from 2020-23.

Latisha Nixon-Jones, a law professor at Jacksonville University, wrote in March in the The Conversation, a news organization that features articles written by academic experts, cited three reasons for the dysfunction in the home insurance market:

Natural disasters are becoming more common and costly (we agree with her on the costly, not so much on the common).

The price of reinsurance (basically, insurance for insurers) is soaring.

The state’s litigation-friendly environment makes it easy for customers to sue their insurers.

So What Happens When the Big One Hits?

When the category 5 storm Hurricane Andrew hit Dade County on August 24, 1992, winds of over 165 miles per hour and a 17-foot storm surge destroyed 50,000 homes, and damaged more than 100,000 others. Forty-three were killed and some 250,000 were left homeless, according to the National Weather Service.

The price tag then was about $26 billion in damages and $15 billion in insurance costs. Accounting for inflation, the damages from Andrew would have doubled to about $50 billion in just 30 years. But given the growth in Florida’s population and the increase in the number of buildings that would be affected by a large storm, recovery costs would be far higher.

Swiss Re, a global reinsurer for several insurance companies in Florida, said in 2022 that their models predict a current day Hurricane Andrew would cost the state more than $120 billion four times what it did in 1992, and at least half of that is insurance costs.

The state’s building code has since been revised, requiring impact-resistant glass, shutter systems and stronger materials, so more homes should be able to withstand some storms. But there are so many more of them — the population has jumped from 13.5 million in 1992 to nearly 23 million today — that the damage from the next major storm will likely be the most expensive ever.

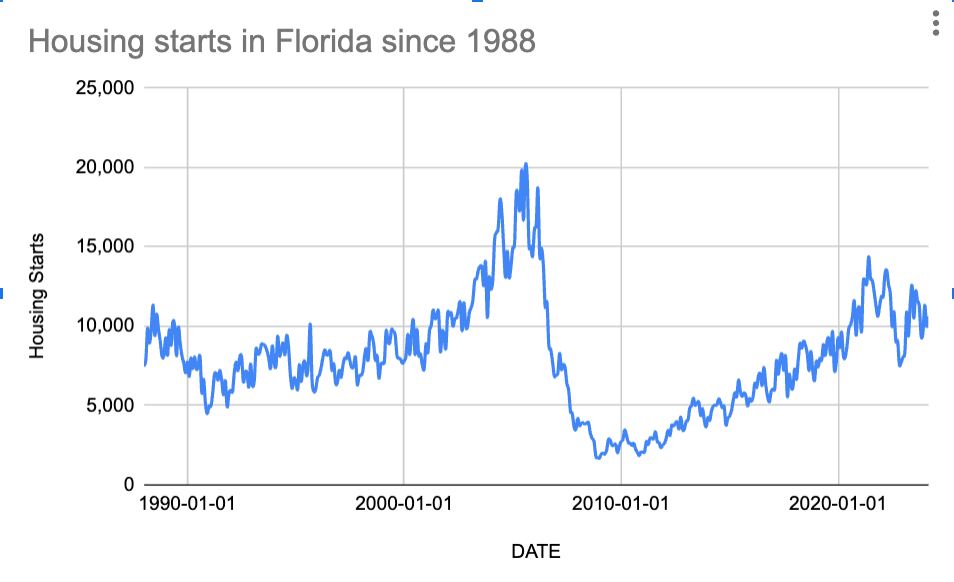

For an idea of how many more properties are at risk, it’s useful to look at housing starts in Florida since 1988.

A few highlights:

Housing starts peaked at 20,044 in August of 2005 before tanking to 1,694 in January of 2009 (see mortgage crisis, U.S.)

By June of 2009, housing starts had passed 2,800 and steadily rose into 2021

In June of 2021, they peaked 14,372

They have averaged about 10,000 a month over the last 3 years

The increase in replacement building costs will make recovery from the next big storm an even bigger challenge, and is one of the reasons insurers are reluctant to do business in Florida these days.

The upshot is that average insurance premiums cost homeowners some $6,000 a year in Florida, more than triple the national average and about three times what Floridians paid on average for insurance premiums in 2018.

Land Use Planning, or Lack Thereof?

Take the example of Cape Coral, one of the fastest-growing cities in the U.S. Its population is expected to hit nearly 240,000 people this year, more than double the 102,000 it had in 2000. Since 2020, when its population was 195,000, it has grown more than 22%.

Not bad for a boggy swampland with about 200 people and a couple of houses along dirt roads about 60 years ago.

Politico journalist Michael Grunwald, has called it “one of the most notorious land scams in Florida's scammy history.” It’s the creation of Leonard Rosen, who with his brother Jack bought a 103-square mile tract of mangrove swamp across the Caloosahatchee River from Fort Myers in 1957.

They came up with the name “Cape Coral,” and started selling it as an affordable paradise.

“It passed off inaccessible mush as prime real estate, sold the same swampy lots to multiple buyers, and used listening devices to spy on its customers,” Grunwald wrote in Politico Magazine in 2017, just a month after Hurricane Irma caused millions in damage in Cape Coral.

Its swamps have been drained by 400 miles of canals — the most of any city on earth — that serve as the city’s stormwater management system. But those canals have caused an ecological disaster, ravaging wetlands, estuaries and aquifers. Cape Coral was designed without water or sewer pipes, shops or offices; it’s an exclusively residential development, in many cases appealing to owners who can park their boats behind their home.

But that has not stopped people from coming.

Grunwald’s article title had a pretty straightforward assessment: “The Boomtown That Shouldn’t Exist.” He revisited the topic for Atlantic Magazine in 2022, and this time the headline was a bit more ironic: Why the Florida Fantasy Withstands Reality. The text accompanying it was more direct: Cape Coral is a microcosm of Florida’s worst impulse: selling dream homes in a hurricane-prone flood zone. But people still want them.

Grunwald’s Atlantic article coincided with Hurricane Ian. People are still moving to Cape Coral, but there are signs the housing market is softening. RocketHomes’ report for the city in April noted that median prices have fallen 2.7% in the past year, while median prices in nearby Fort Myers rose 1.6%.

A random search of the addresses of Cape Coral homes for sale at the site riskfactor.com, which grades properties on a scale of 1-10 for their risk for flood, fire, wind, air quality, and extreme heat, reveals few surprises. All of them are at a high risk of flooding and wind, some more so than others — see canals, above. If sea levels rise as climatologists predict over the next 50-100 years, Cape Coral will probably look more like the Everglades than an affordable paradise. As for extreme heat, on a scale of 1-10, all the Cape Coral homes earn a perfect 10.

Tens of millions were spent cleaning up after the two recent hurricanes, and though some of that money was spent on hardening structures and storm water projects, there is no talk of abandoning the swamp.

Perhaps it will take a direct hit.

It took nearly a year for parts of the city to recover from Hurricane Irma, and it swerved at the last minute and damage was not as severe as it could have been.

Grunwald described in his Atlantic piece taking a boat ride through the canals with a local, Brian Tattersall, to view the debris Irma left behind in 2022 and asked if this would dissuade the snowbirds from coming to find their bliss waterside. Tattersal’s response: “No way.”

“Look, if we get 15 feet of storm surge, holy shit, that would take out Cape Coral,” Tattersal said. Then he paused, and sipped his beer. “Eh, even then, no way.”

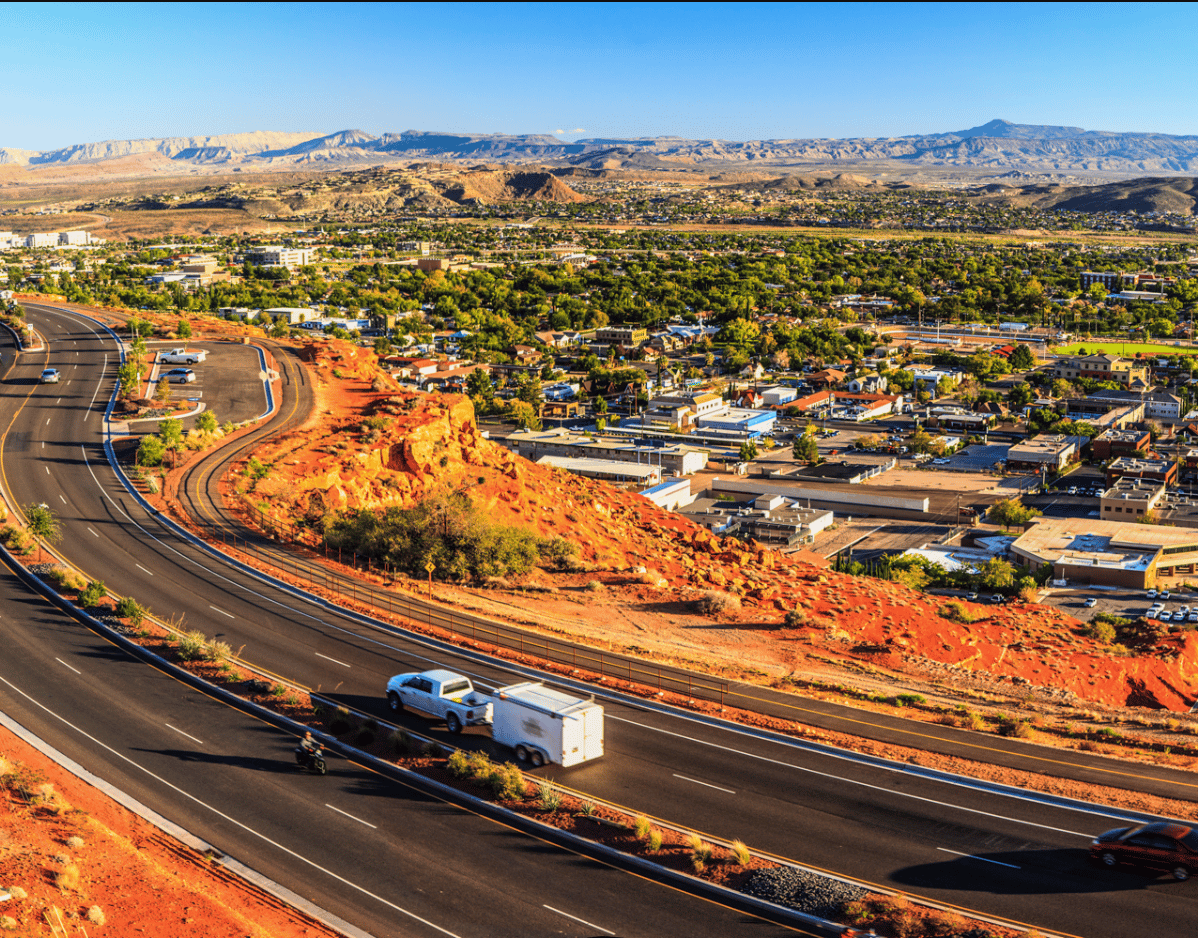

St. George, Utah

Nestled amid the majestic red rock formations of the southwestern desert, St. George, Utah, has emerged as a haven for single-family rental (SFR) investors seeking to capitalize on the city's growing population, robust economy, and high quality of life.

With its year-round sunshine, stunning natural beauty, and vibrant community spirit, St. George makes a compelling case for investors looking to generate steady cash flow and long-term appreciation through residential real estate.

Migration to Small Towns Continues

→ Small city of 90,000 residents with bullish growth projections

→ Migration to small towns continues post pandemic

→ 3.07% annual population growth rate far outpaces the US average

Migration Trends Across the US

“The remote work boom that prompted Americans to flee urban areas for mountain hamlets and seaside towns during the pandemic continued at least through last year,” according to University of Virginia demographer Hamilton Lombard. “An estimated 291,400 people last year migrated from other areas into America’s small towns and rural areas.”

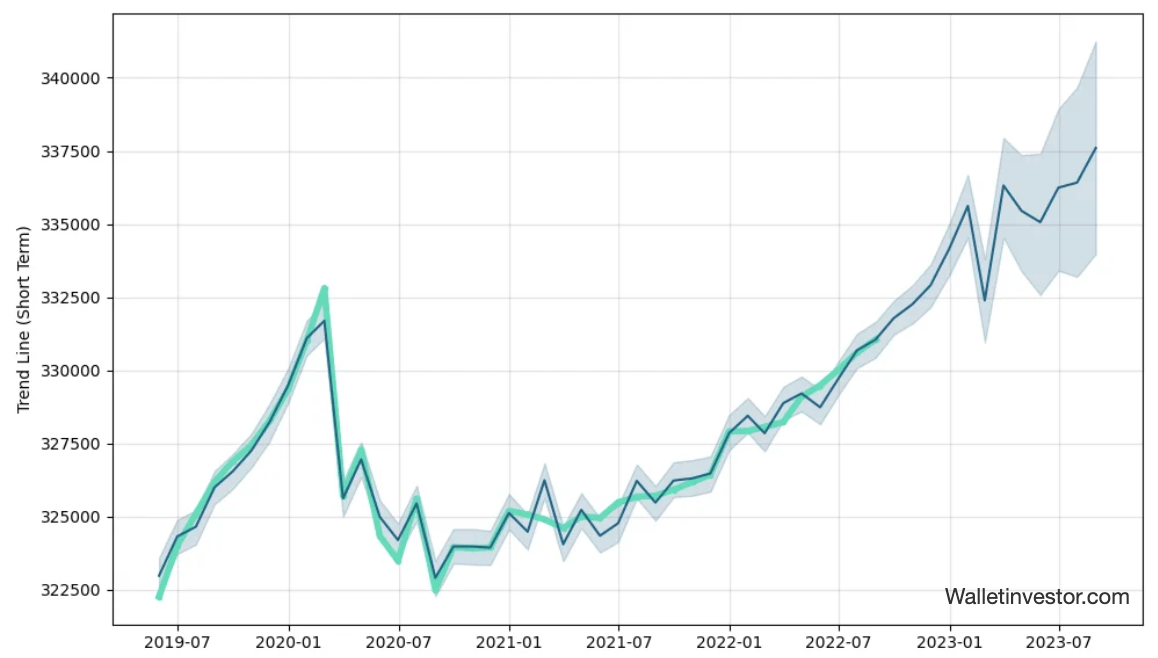

Price Appreciation

80 N Paradise Way

This charming home boasts a delightful blend of comfort and convenience with its cozy 3 bedrooms, 2 bathrooms, and a fully fenced, good-sized backyard, perfect for relaxation and outdoor gatherings. Newly equipped with a range and microwave, along with fresh carpet and meticulously cleaned grout, this home exudes warmth and care at every corner. It's a haven for those seeking a well-maintained and inviting living space. No HOA.

The Investment Thesis

→ US population continuing to move into smaller cities post pandemic

→ Close to Zion National park and other outdoor activities

→ St George is growing at a rate of 3.07% annually far outpacing the US average

Property Details

Yr Built: 1996 | Type: SFR |

Sqft: 1,068 | Bed/Bath: 3 , 2 |

Financial Projections

Asking Price: $415,000 | 5 Yr Appreciation: $89,910 |

Rent: $1,880 | Annual Gross Income: $22,560 |

Interested in Learning More?

*Appreciation based on 4.5% growth rate.

Proptech Is Not Real: The Reality Behind the Hype

Josh Panknin, a professor at Columbia University, recently dropped some napalm on his LinkedIn audience in what was one of the more sobering messages for real estate technology professionals: stop buying the hype.

He leads by quoting himself from 18 months ago.

“I predict there will be massive losses for many proptech investors in the coming years as the market begins to realize that good stories don’t make good products or good businesses.”

His reasoning is based on two main factors that explain why the macroeconomic environment is often cited as the reason for widespread financial difficulties among proptech startups

1. False Claims

The first reason, according to Panknin, for why we are seeing proptech startups fail is tied to technology claims that are technically infeasible. There is a mismatch between the data that is available and what data is required to solve the problem.

2. Industry Subject Matter Expertise

Panknin highlights the gap in subject matter expertise between strong technology operators and hardened real estate professionals. Tech works well in an environment where the solution is built once, then scaled at a very low cost to serve the many. This doesn’t work in real estate, where every home, every tenant is different.

Our Take

Mr. Panknin is spot-on in his assessment and it’s a message all aspiring proptech professionals should reflect on.

There are two reasons we believe proptech 1.0 will close out as a failed experiment and why there is room for optimism moving forward.

1. Business Model x Venture Capital Misalignment

Venture capital is attracted to large markets that touch many people. Insert real estate. Housing is a need so important that you can find it second on Maslov’s Hierarchy of Needs, behind only physiological needs. So the TAM (total addressable market) is eye-watering.

Venture capital is also often directed at hyper scale potential. Their game is to invest in businesses with exponential growth, fuel that growth over a 5-8 year period, and exit with a big payout. The returns on the capital for the lock up period should far exceed alternative investment options for their partners.

However, some venture capitalists misunderstand how a heavily regulated industry and a heterogeneous product/service is immune to hypergrowth. Every transaction is different and solving these nuances requires more people, and more people for every additional unit adds variable cost to the transaction. Given this misalignment, businesses with higher marginal costs fundamentally don’t play well in the sandbox with venture funds.

2. Industry Expertise

This one is often the most challenging in the property technology space. The most experienced in traditional real estate and the most talented outside of the real estate industry are equally dangerous. The experienced vet is often stuck in their ways and too wrapped up in the regulatory web. The experienced outsider can be a brilliant, successful leader who will not comprehend all of the things out of their control given how overregulated the real estate industry is. Few industries (healthcare maybe?) require so much understanding before a business can be built, unless it’s ok to burn cash while waiting for the scale to kick in.

Where Do We Go From Here?

The days of dumping billions into a real estate services company with a cool brand and nice story are mostly gone. This industry, similar to SaaS, is back to first principles and an emphasis on efficient revenue vs growth at all costs.

We should expect fewer potential target employers in proptech given this new reality, but find comfort in the fact that breakneck RIF’s where teams are cut 3-4 times per year won’t be the norm.

You can read Mr. Panknin’s post on linkedin. Don’t forget to give him a follow, too.

StayFrank.

Founded with the vision of alleviating financial stress for homeowners who need cash but are locked out of traditional home equity solutions, StayFrank offers owners the opportunity to access funds by selling their home while avoiding the disruption of moving.

StayFrank’s solutions — Home Sale-Leaseback and the Home Equity Agreement — help unlock accumulated equity, provide peace of mind, eliminate the need to relocate, and restore homeowners’ ability to live on their terms.

Its sale-leaseback programs also supply investment-grade inventory to Single-Family Rental (SFR) operators across various states. StayFrank’s program leverages the homeowners existing low-rate mortgages and boast an average Internal Rate of Return (IRR) of 17-22% in highly sought-after markets, such as Phoenix, Atlanta, and Dallas.

Founder’s Journey: A Real Estate Operator

Derek Jarr, the founder and CEO of StayFrank, is a seasoned professional with over 20 years in the real estate sector. His journey began as a cash home buyer, renovating and renting out homes in and around Phoenix. His background expanded beyond traditional acquisitions strategies:

2000-07 Creative finance, flips, rentals, and sale-leasebacks. Was introduced to the idea of a sale-leaseback when a homeowner in foreclosure said they would only sell their home if they could lease it back.

2008-12 Short sales and aggregating properties for early SFR operators as single-family rentals as an asset class started gaining momentum.

2013-20 Developed nearly 100 single-family homes on infill lots; his largest project was a 21-home community.

2022+ StayFrank was designed to enable homeowners to access their swiftly increasing equity, while meeting demand for Single-Family Rental (SFR) assets from institutional investors.

“Real estate is ever changing, no one beats the market,” Jarr said during an interview with proptext. “You either adapt or you die. There is no such thing as a perfect time and if you want a long career in the industry, you must always look ahead.”

What Is a Sale-Leaseback? 🏠

A sale-leaseback is a transaction where a homeowner sells their house and then leases it back, living in the home as a tenant, while tapping into the equity they have built up. This arrangement offers a stable investment opportunity for the Investor and financial liquidity for the seller.

What Makes StayFrank Different for Owners?

StayFrank said it differentiates itself from competitors by focusing on a personalized sale-leaseback experience that emphasizes homeowner needs and financial flexibility.

“We can reduce the financial stress hanging over a homeowner without having to deal with the added stress of moving,” Jarr said. “We do this with a very empathetic sales process — knowing that selling a home, especially during stressful times, can be one of the most difficult things a person goes through.”

In most cases, a portion of the lease is prepaid when the deal closes. Some sale leasebacks provide the homeowner the option to buy the house back at a predetermined price, at which point they can keep it, or resell and pay off the option price to the investor. In either case, the tenant has an incentive to take care of the property as they have an opportunity for additional financial gain.

What Makes StayFrank Different for Investors?

In a market with compressed returns in a higher interest rate environment, StayFrank deal flow differentiates itself in two distinct ways.

Opportunistic Acquisition - acquiring homes at lower price points, coupled with low mortgage rates that are in place, yields a higher return on investment.

Reliable Tenancy - tenants are former owners and have that owner mindset; and some will want to buy back the home. This alignment in goals lowers the risk of vacancy and reduces maintenance issues for the investor.

How Do I Get Started? ☎️

Whether you’re a homeowner looking to leverage your home equity without moving or an investor looking for better returns from leveraging existing low interest mortgages on single-family rental deals, StayFrank has you covered.

For owners interested in finding out how they can tap equity and stay in place, schedule a call with the team.

For investors interested in deploying $1-$10M in capital for deals averaging 17-22% IRR (internal rate of return), reach out to Derek for more information.

Disclosure: prop.text was not paid for this piece.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

{{rp_peronalized_text}}

Copy & paste this link: {{rp_refer_url}}

Buy prop.text Swag 🛒

You can buy your own prop.text merchandise

Coming Soon

100% of the proceeds go toward making this the best real estate investment newsletter for our valued readers.