Welcome, prop.text readers!

In issue 31, we dive into the pause behind selling public land, climate gentrification, accidental landlords and more

publicly.traded → The pause on selling publicly owned land out West

industry.chatter → Climate gentrification

beyond.the.curve → Market snapshot

todays.sponsor → AIR Insider

Plan to Sell Western Lands Shelved, for Now

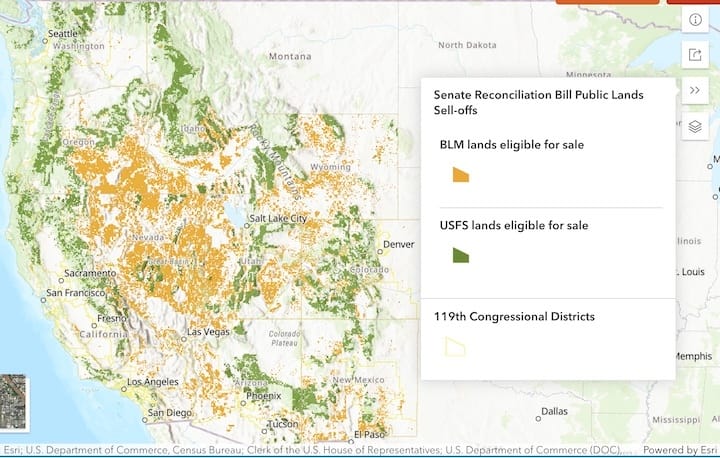

Republicans and advocates for development have been pushing for some time to sell off federal lands in the West, where the government owns 30 to 80% of the land, depending on the state. Some say this would help address the affordable housing crisis, though most of this land is far from population centers, where developers want to build, and much of it is protected national parks, forests, and wildlife refuges. A lot of it is used for grazing cattle and drilling for oil. (See map above from Wilderness.org.)

A proposal to sell more than 2 million acres in the Republican tax bill was nixed by the Senate parliamentarian on June 23, saying it violated the chamber’s rules. Senate Energy Chairman Mike Lee Lee, the Utah Republican who sponsored it, said a revised plan would remove all US Forest Service land, and sites overseen by the US Bureau of Land Management would only include those within 5 miles of population centers.

But it turns out a lot of people who live out West, both Democrats and Republicans, aren’t too keen on seeing public lands sold off and developed, according to The New York Times. And apparently it’s easier to build a $6 million vacation home in paradise than apartments, duplexes and a senior-living center, which Summit County, Colo., discovered when it bought 45 acres from the Forest Service for $1.75 million for that purpose in 2016. Wildfires, traffic, and the prospect of new water and sewer systems have held up the project. Local officials now wonder if the project will get done in their lifetime.

“These things are complicated,” Michael Carroll, a Colorado-based campaign director at the Wilderness Society, told The Times.

Even those who are forced to share substandard housing and would benefit from more development are leery of selling off federal land.

“There’s no way,” Zyle Yelton, 24, who manages a liquor store below the peaks looming over the ski town of Breckenridge, said of Lee’s plan. One winter, he shared a 600-square-foot apartment with three guys, and now lives a $4,000 a month rental up a dirt road with his girlfriend and two other roommates.

Yelton and others who live in these places do so because they can hike, camp and hunt in the nearby mountains. “I’d love to live here for the rest of my life,” he said, “if I could afford a place.”

Governors of Western states also had mixed reactions. New Mexico Gov. Michelle Lujan Grisham, a Democrat, told NPR that many of her constituents have close ties to public lands.

Wyoming Gov. Mark Gordon, a Republican, was open to the idea.

“On a piece-by-piece basis where states have the opportunity to craft policies that make sense,” Gordon said at a news conference in Santa Fe, New Mexico, where the Western Governors’ Association was meeting. “We can actually allow for some responsible growth in areas with communities that are landlocked at this point.”

Lee said he would keep trying, but it’s unclear if he can get around Senate rules.

“Housing prices are crushing families and keeping young Americans from living where they grew up. We need to change that,” he wrote on X.

The federal government already has procedures for agencies such as the US Forest Service and Bureau of Land Management, to sell, lease or trade property with local governments to build homes, Lee’s opponents pointed out.

The Wall Street Journal wrote in an editorial that the sale, which unsurprisingly it supported, would exclude national parks and monuments, and land already leased for mining, energy production and grazing. Federal agencies were to prioritize land near existing roads or where homes could be built. Governors would be consulted before land was auctioned off, and state and local governments would have the right of first refusal.

Brian Potter noted in his Construction Physics substack — which inspired this post — that the idea that this land will be developed “seems dubious” since most of it is nowhere near where there is demand for housing. (Hello California!)

The reality is land is pricey in the areas where the affordability crisis and housing shortages are most acute — including the superstar cities like Los Angeles, New York, San Francisco, Boston, etc. — and regulations make it difficult to increase density. Opening up federal lands is unlikely to reduce the housing shortage in the US, which is estimated at 4 to 7 million homes, and the solutions to that are more complex and nuanced than those pitched in President Trump’s “One Big Beautiful Bill.”

Potter looked over the Wilderness.org map and said some of the property is near developed areas, and there may be enough parcels to make a small dent in the housing shortage. Three million acres represent less than 0.5% of the 600 million-plus acres of land the federal government owns, so this is not a significant sell off, though environmentalists and outdoor activists have been predictably opposed.

The notion of selling off federal land isn’t new; between 1990 and 2018 the federal government sold around 31 million acres of federal land, most of it in Alaska, as well as Department of Defense divestments following the end of the Cold War.

“Climate gentrification” is suddenly a hot topic (sorry for the pun). This occurs when natural disasters drive out the poors and the rich move in and rebuild, and there are fears that middle-class areas in Los Angeles that burned like Altadena are about to experience this. Pauline Hohenthaner has seen it first-hand in Paradise, Calif., where she has been selling real estate for 40 years. After the Camp Fire in 2018, which killed 85 and destroyed 15,000 structures, she started getting calls before the ashes were cool. Business has been good since, with modern modular homes fetching over $300,000, and stick-built homes $500,000 or more — far above pre-fire prices. Hohenthaner lost two buildings and a garage, but she and her husband rebuilt with insurance money, property which is now safer and worth more. “The fire did us good, I hate to say that,” Hohenthaner, 69, told the Wall Street Journal (paywalled). “Now we’re on the other side of it, and we’re happy.” Well, some are happy. One study of the Camp Fire this year found that the more than $1 billion of federal aid “facilitated displacement and gentrification by enabling socially advantaged previous and new residents to return and rebuild.”

There has been a surge of accidental landlords, homeowners who decided to rent their property after they could not sell, according to the real estate analytic company Parcl Labs. Here are some of the numbers they highlighted in a LinkedIn post:

Over one-third (36.8%) of all institutionally-owned single-family homes are in just 6 markets: Atlanta, Phoenix, Dallas, Houston, Tampa, and Charlotte.

These markets are facing housing stress on the for-sale side:

Charlotte: 38.2% year-over-year inventory growth

Dallas: 37.7%

Atlanta: +34.1%

Some frustrated sellers are becoming accidental landlords Conversions from for-sale to for-rent are are up:

Houston: +41.4% year over year

Dallas: +32.3%

These accidental landlords now compete directly in markets where institutions placed their biggest bets. Institutional owners are selling, and nearly 77% of their sales are in these 6 markets.

Last week, Compass sued Zillow, accusing it of conspiring to maintain a monopoly over digital home listings. Zillow has about 227 million unique visitors every month, the most of any site. Compass sells more homes than any of its competitors. This latest spat stems from Zillow’s announcement in April that any home put on the market but not available for listing on Zillow within 24 hours would be banned from its site. This would leave off Compass’s Private Exclusives, a channel of about 7,000 home listings available only to Compass agents and their buyers. For a good explainer on what is really going on with the listings fight, see proptext’s piece from a few issues ago.

Just Because

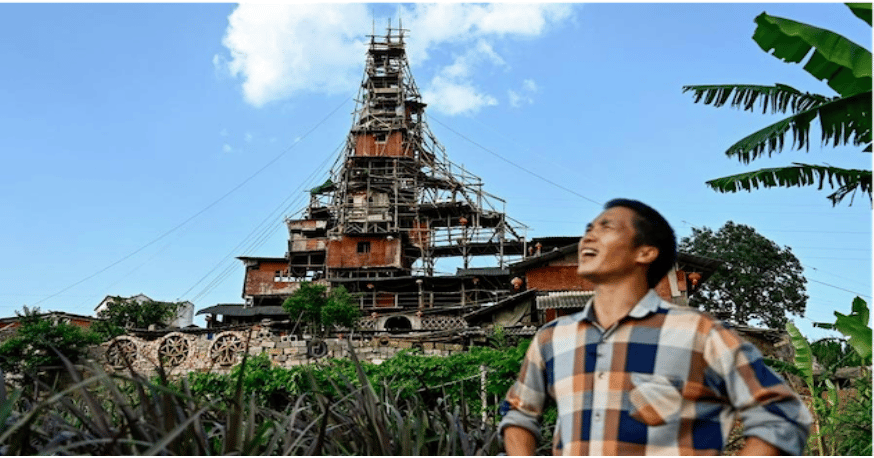

In this week’s weird real estate news, we found a Chinese man who has lashed together a 10-story pyramid above the house his grandfather built in the 1980s, in the process defying numerous orders to demolish it and vacate the premises. Most of the Guizhou province village where the house is was razed in 2018 to build a tourist resort, but the resort was never built. His home now qualifies as a “nail house,” properties that delay large construction projects or force developers to divert roads or build around shabby older homes. “People often say it’s unsafe and should be demolished,” Chen Tianming said. “But I’ll definitely never let anyone tear it down.” He may not have to. Reports say the higher floors where he sleeps sway in the wind, despite the dozens of ropes and cables tethering the house to the ground. The house has become a sensation on Chinese social media and a tourist attraction.

30-Year Mortgage Rate: 6.84% (as of June 27, 2025) ↔ Steady (down from 7.03% in early June) | Slight relief for buyers, but still historically high — affordability remains tight. |

Refinance applications: 7% rise week over week. | With slightly falling mortgage rates, demand for refinancing was 40% higher than the same week one year ago. |

Price Reductions Share: 20–22% of listings (June) ↑ from ~18% in May | Rising seller concessions — signals buyer hesitation + overpricing. |

Homes for Sale ≥ 60 Days ("Stale Listings"): ~44% of active listings (≈$331B worth) | High stale inventory signals buyer leverage and selective selling. |

Median Days on Market: ~45 days (June). +6–7 days YoY | Sellers face longer turnover times, giving buyers negotiation leverage. |

Sales & Marketing roles:

Content Marketing Manager, Dealpath, New York

Marketing Lead, EliseAI, New York

Coordinator, Demand Generation, Compass, Miami

Product & Engineering roles:

Senior AI Engineer, Roofstock, Oakland, CA

DevOps Engineer, EliseAI, New York

Fullstack Software Engineer, PermitFlow, Remote

Operations roles:

Strategy and Operations Manager, EliseAI, New York

General Manager, Power Hosts, Neighbor, Lehi, UT

Operations Escrow Officer, Doma, Remote

Get access to the most exclusive offers for private market investors

Looking to invest in real estate, private credit, pre-IPO venture or crypto? AIR Insiders get exclusive offers and perks from leading private market investing tools and platforms, like:

Up to $250 free from Percent

50% off tax and retirement planning from Carry

$50 of free stock from Public

A free subscription to Worth Magazine

$1000 off an annual subscription to DealSheet

and offers from CapitalPad, Groundfloor, Fundrise, Mogul, and more.

Just sign up for our 2-week free trial to experience all the benefits of being an AIR Insider.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}