Welcome, prop.text readers!

In issue 35, we explore why Lennar started courting investors for SFR along with why fix and flip investors are biting nails not hammering them.

publicly.traded → Lennar unveils investor portal

industry.chatter → Trouble for Fix and Flips beyond.the.curve → Mortgage rates and inventory

As Home Sales Lag, Huge Builder Lennar Unveils Investor Portal

The slump in home sales is spreading across all levels of the industry, and waiting for traditional buyers to return is a losers’ game.

The nation’s second-largest homebuilder, which is sitting on more unsold homes than at any point since 2009, decided to get creative. Lennar, which is valued at $34 billion, has rolled out an online portal aimed squarely at mom-and-pop landlords and small investors, Fast Company recently reported.

Inventory stands at 119,000 unsold homes as of June 2025, the most since 16 years ago at the height of the housing crisis.

Lennar Investor Marketplace has offers on homes in Florida with a 7/6 ARM with interest rates as low as 4.99%.

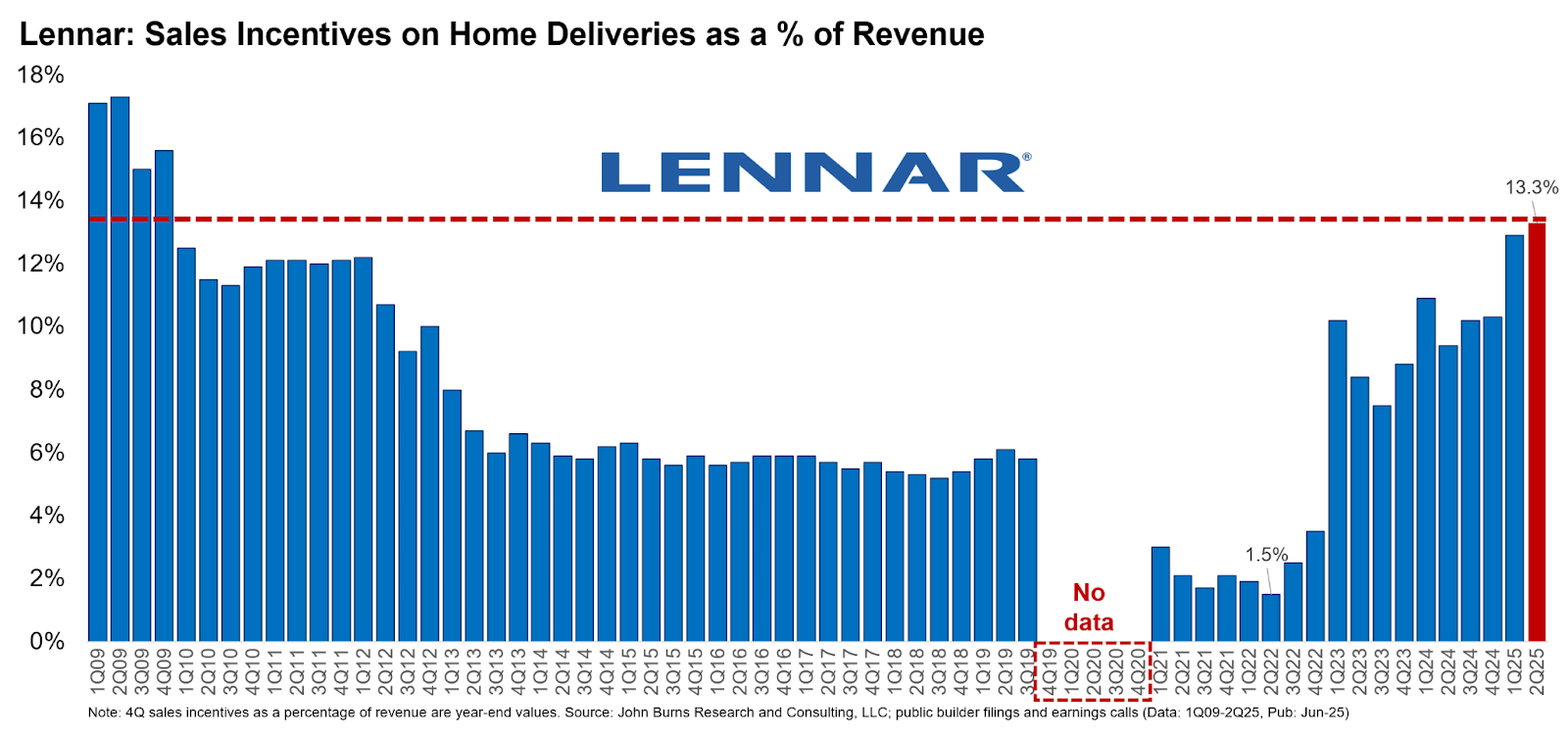

The company has ratcheted up its incentives — spending roughly 13.3 percent of a home’s final sale price on inducements like rate buydowns. On a $400,000 property, that amounts to an eye-popping $53,200, the highest since 2009.

The investor portal also offers customizable projections — rental yield, cash flow, and appreciation — although each investor should do their own underwriting. In soft markets across Florida, Texas, and the Mountain West, these investor tools could tip the scale on negotiating leverage.

According to The New York Times, surging mortgage rates and a flood of unsold homes have forced builders, including giants such as D.R. Horton and KB Home, to sweeten deals with generous incentives — from temporary rate buydowns to budget-draining upgrades — to keep sales flowing.

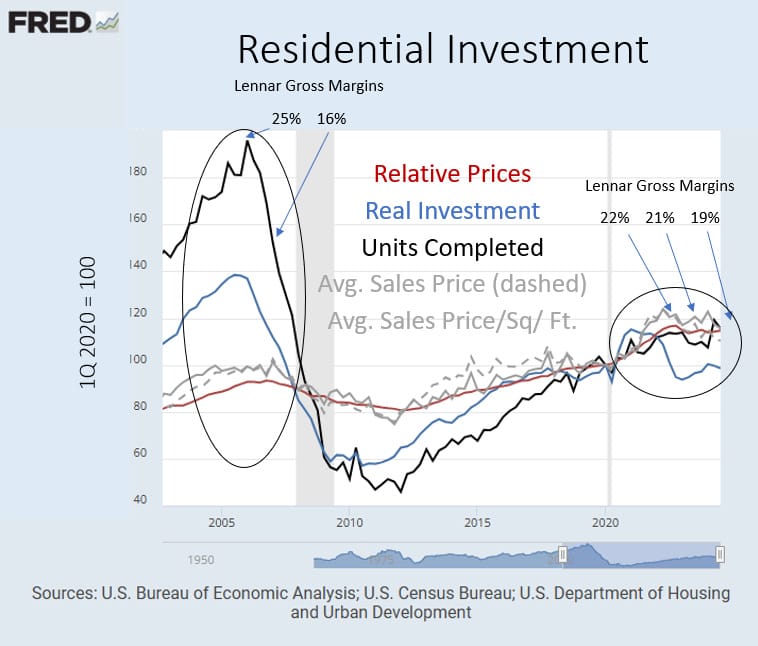

Lennar has managed to control its costs by buying materials in volume and building only as much as the market will bear.

“Our construction costs have actually decreased over the past two and a half years,” Stuart A. Miller, an executive at Lennar said on an earnings call in June. “As the market has gotten even more difficult, and given the continued deterioration in market condition, we are putting increasing pressure on our trade partners to force costs down further.”

Still, there is no getting around the chill in this summer’s market, which is normally prime buying season. Sales for new single-family homes in July were down 0.6 percent from June and 8.2 percent from the year before, according to the U.S. Census Bureau.

The enticements from home builders signal a deeper stress in the industry: hesitations among prospective homeowners, rising construction expenses, and growing inventory have flipped the script, forcing suppliers into defensive tactics rather than leading pricing or volume.

In markets where buyers have retreated, builders are scrambling to stimulate demand, marking a striking shift after years of weakness on the supply side. The message is clear: amid mounting financial headwinds, the housing market's vigor now depends more on affordability strategies than on traditional supply constraints.

At the same time, however, other Census Bureau data surprised analysts: overall housing starts rose 5.2 percent to 1.428 million units — the highest pace in five months — while single-family starts climbed 2.8 percent to 939,000 units. Much of the gain came from a burst in multifamily construction, which surged nearly 12 percent — and pushed overall residential starts higher.

Fix-and-flip investors are biting their nails these days, not hammering them. Or rather, stepping back entirely. Higher borrowing costs and construction expenses are squeezing professionals in the flipping space, and the time it takes to sell renovated homes is stretching longer than expected, according to CNBC. A joint index from John Burns Research and lender Kiavi paints a clear picture of rising unease: only 30% of flippers reported “good” sales in Q2, down from 38% a year ago. The problem? Homes are languishing on the market longer, tying up capital and delaying reinvestment opportunities. A shrinking labor pool – with boomers retiring and stricter immigration — and the outlook for flippers is not a bright one.

Foreign buyers are stepping back into the market, according to a recent report from the National Association of Realtors. Foreign investors accounted for 44 percent of all US home purchases by noncitizens over the past year, according to Bloomberg. As many Americans hesitate, constrained by economic pressures, the surge in global buyers underscores how international capital now plays a decisive role in buoying the US housing market.

A recent analysis found that nearly 1 in 5 homes in California, or 19% of the state's housing stock, are owned by investors. While this proportion is slightly below the national average of 20%, it reflects a broader trend of increasing investor presence in the housing market. The rise in investor-owned homes, combined with increasing foreign and corporate investment.

Just Because

Seth and Tori Bolt turned a modest investment — $237,000 for a land purchase — into a $32 million treehouse resort business in just four years, centered around Bolt Farm in Tennessee. With an average nightly rate of around $700 and a 93% occupancy rate, their model caters to the demand for experiential lodging. They offer wellness programs and unique properties that include treehouses, domes, mirror cabins, and a “Floating Mirror,” a cabin suspended between two boulders, wrapped in mirrored glass. The couple decided not to list their properties on platforms like Airbnb, and instead focused on building their own website and booking system, allowing them to keep more profits and build stronger relationships with guests. They encourage their guests “to turn off their cell phones & clear their schedule to unlock the magic of distraction-free quality time.”

30-Year Fixed Mortgage Rate: ↓ Slightly from ~6.70%. Lowest rate for 2025 | Rate relief improves affordability—but still relatively high. |

Housing Inventory (Active Listings): 1.55M homes—a 5-year high; 24.8% YoY inventory increase | Growing supply gives buyers more options; easing price growth. |

Median Sales Price (Existing Homes): $422,400, +0.2% YoY—the slowest annual rise in 25 months | Price appreciation cooling, providing better affordability dynamics. |

Price Reductions: 20.6% of listings saw cuts in July. ↘ Slight dip from June but still elevated | Sellers are retreating—and concessions remain common. |

Redfin Purchase Cancellations (July): 15.3% of deals fell through—the highest July level on record | Buyer hesitation remains high; deals increasingly fragile. |

Sales & Marketing roles:

Outside Sales Development Representative, Runwise, Washington DC

Strategic Growth Manager, Compass, Atlanta, GA

Strategic Account Director, SmartRent, Phoenix, AZ

Product & Engineering roles:

Analytics Engineer, PermitFlow, New York, NY

Senior Manager, Program Management - AI, Compass, Seattle, WA

AI/ML Engineer, Homebound, Remote

Operations roles:

Lead Program Manager, Process Excellence, Compass, New York, NY

Discover the measurable impacts of AI agents for customer support

How Did Papaya Slash Support Costs Without Adding Headcount?

When Papaya saw support tickets surge, they faced a tough choice: hire more agents or risk slower service. Instead, they found a third option—one that scaled their support without scaling their team.

The secret? An AI-powered support agent from Maven AGI that started resolving customer inquiries on day one.

With Maven AGI, Papaya now handles 90% of inquiries automatically - cutting costs in half while improving response times and customer satisfaction. No more rigid decision trees. No more endless manual upkeep. Just fast, accurate answers at scale.

The best part? Their human team is free to focus on the complex, high-value issues that matter most.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}