Welcome, prop.text readers!

In issue 53, we explore construction industry’s productivity problems

publicly.traded → Is Factory-Built the Answer?

industry.chatter → McMansions are out.

beyond.the.curve → Housing starts, active listings and inventory

Construction’s Productivity Problem

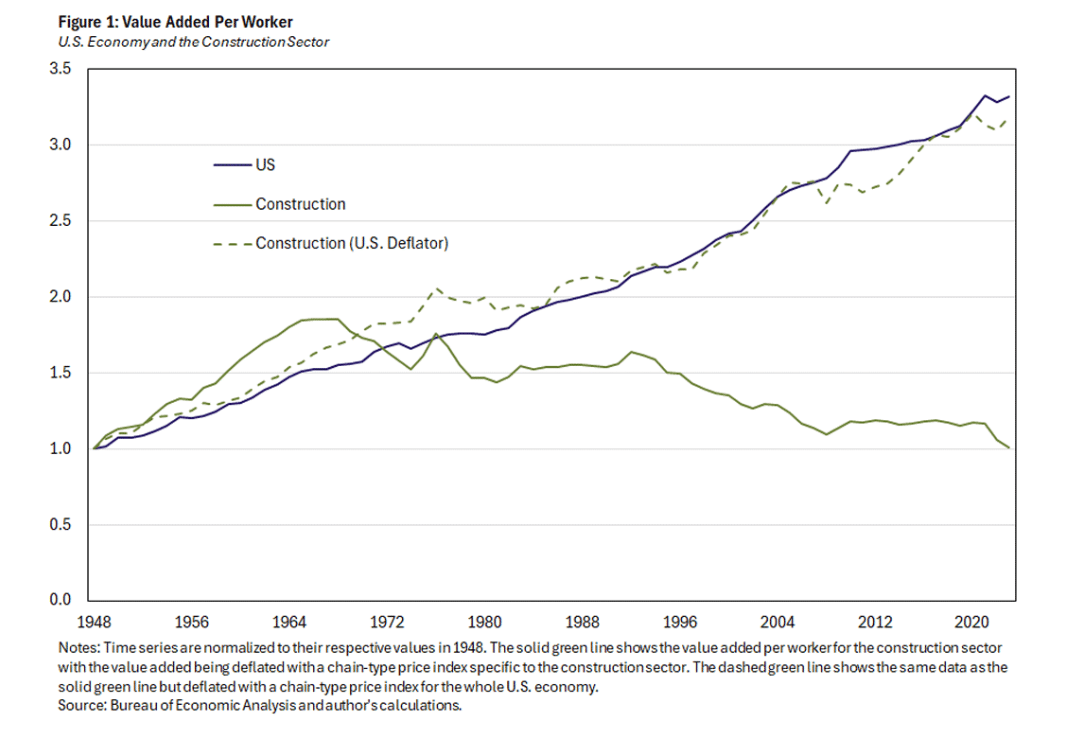

prop.text stays on top of the latest and greatest in construction technology, and we, like many people in the industry, are struck by the dearth of productivity gains. Most homes in the US are still stick-built, and labor productivity in the construction industry fell by more than 30 percent from 1970 to 2020, while economic productivity in the same period doubled, according to a report from the Federal Reserve Board of Richmond.

So has the time come for modular builders, or the structural insulated panel industry, or some other factory-driven approach to housing, to take a more prominent role? (Beware of predictions in the real estate market is another mantra we like to keep in mind.)

Still, the assembly line innovation that Henry Ford came up with to build cars more than a century ago has so far eluded the nation’s home builders.

“When you go to buy a car, you don't get 6,000 parts shipped to your house and then someone comes and builds it for you,” Ryan Cassidy, vice president of real estate development at Mutual Housing California, told the Los Angeles Times. MHC is an affordable housing developer based in Sacramento that committed last year to build its next five projects with factory-built units.

This decline in productivity has fueled the affordability crisis that has gripped the US housing market and also undermined economic growth, according to the Fed report. In 2024, construction made up about 4.5 percent of gross domestic product and since it supplies capital to other sectors of the economy, its productivity decline amplifies that impact.

A 2022 paper concluded that the construction sector accounted for about one-third of the decline in GDP growth since World War II, or a loss of about $1 trillion every five years.

SIP Technology: Old Is New Again?

Structural Insulated Panel (SIP) technology is nothing new — it has been around since the 1930s — but it has become more competitive on price as the cost of framing lumber has risen. Building with these prefabricated panels, which are made up of a rigid foam insulation core between two structural facings (usually oriented strand board), can speed up construction by up to 50% and reduce the labor needed to frame a building by up to 55% compared to traditional methods.

These prefabricated sections are fitted together onsite and then screwed and nailed together. They make buildings that are structurally strong, energy efficient and are more eco-friendly than other methods. (There are loads of videos online about SIP building if you are so inclined.)

There are downsides to SIP building as with other newer technologies, such as 3D printed homes — among those are the limitations on renovating after the structure is built. SIP structures are also susceptible to moisture damage and are plagued by reduced airflow.

After a flurry of articles about the potential of 3D printed homes, proptext looked behind the curtain and the reality was a little less than advertised. Our conclusion was that 3D printing was not about to make a dent in the country’s crushing shortage of homes, which is pegged at 4 or 5 or 7 million depending on the source.

Likewise with SIP, which seems to be the latest flavor of the month. American Housing Corporation, a new outfit that claims to be a vertically integrated developer — buying land, building homes and selling them — is employing SIP technology for its construction.

It is also making claims that its mission is to save the American dream, though their version of it is the old-school row house in urban areas where people can walk to work, shopping and recreation.

This is an appealing idea, particularly among coastal elites. Bobby Fijan, the company’s co-founder, has been the guest at several influential podcasts, including the Washington Post’s with Megan McArdle. These are the type of folks who lament the fact that a classic six on the Upper West Side can no longer be had for $235,000 and families are forced to leave for the suburbs. (Earth to 1956: Don Draper moved his family to Ossining in the “Mad Men” era.)

Fijan is promising to build affordable, well-designed rowhouses for families who crave city life. Lots of other media outlets have piled on, and Fijan and AHC have also been featured in New York, Vox, and The Atlantic.

We’ll wait and see how many homes AHC builds before we invite Fijan on the podcast we might start one day, but for now we’ll trust the Lennars and DR Hortons of the world to keep building homes that people will buy.

Is Factory-Built the Answer?

There is much interest in construction trends in Europe, where more and more building is taking place in factories. In Sweden, about half of homes are factory-built.

In 1998, and as recently as 2023, about 7% of homes built in America were modular or made with panels, according to a report from the National Association of Home Builders. But those gains were ephemeral, and this despite the need for productivity improvements in the construction industry. The report went on (bold italics ours):

In 2024, 28,000 single-family homes were built using modular or panelized/pre-cut construction methods out of 1,019,000 total single-family homes completed, making the total market share for offsite construction just 3%. …

There is potential for offsite construction to gain momentum in the years ahead with the residential construction sector needing an increase in productivity.

The fall-off in modular building contrasts with the trend lines of manufactured housing (aka mobile homes), which neared 10% of all home starts last year and now make up approximately 5.4% of US housing stock. This is largely driven by affordability issues, but it’s also a reflection of how much better the products being offered by the companies that build manufactured homes. (We looked, and were surprised.)

In an article about the push in California to promote factory-built housing, the LA Times pointed out one of the biggest issues holding it back (Another prop.text mantra: beware of government initiatives to “help” the housing industry):

Factories are hugely expensive to set up and run. Off-site construction companies only stand to make up those costs if they can run continuously and at full capacity. …That means factory production isn’t especially well-suited to industries that boom and bust, in which surplus production can’t be stockpiled in a warehouse and everything is made to order and where local variations in climate, topography and regulation require bespoke products of varying materials, designs, configurations and sizes.

The 2021 flameout of Silicon Valley-based modular start up Katerra, which burned through $2 billion in just six years trying to disrupt home-building, looms over the $10 trillion industry.

By the time it filed for bankruptcy, Katerra was making design software, air conditioning systems, windows, and also working in general contracting, architectural design, engineering, project management and cleaning services, according to an article in Architect Magazine.

Brian Potter, a former Katerra engineer, told the LA Times that at one time he believed that “we’ll just move this into a factory and we will yield enormous improvements.”

Potter, who now writes the widely read Construction Physics newsletter (and prop.text source material), acknowledges that the factory-built model is a tough problem to solve, and it has a limited upside.

“Beyond just the regulatory issues, which are real, there are just fundamental nature of the market, nature of the process, things that you have to cope with,” he said.

In a recent piece from Fox Business, the once-coveted McMansion is recast less as a status symbol and more as a creeping liability. As insurance premiums climb, property taxes rise, and utility bills swell, many homeowners are discovering that square footage for its own sake can be an expensive indulgence. Buyers, the article suggests, haven’t abandoned space entirely — but they’re becoming more surgical about it. Instead of cavernous foyers and rarely used formal living rooms, they’re gravitating toward efficient layouts, energy-smart systems, and homes that feel intentional rather than inflated. In this market, excess is out; optimization is in. And for sellers holding onto aging, oversized properties, the message is clear: modernize, streamline, or risk being left behind.

10-Year Yield: ~4.08% | Treasury yields have fallen from typical early-year ranges, reflecting safe-haven demand and cooling inflation data |

30-Year Fixed Mortgage Rate (Zillow): ~6.09% | Some lenders report 30-yr fixed below 6%. It’s a notable milestone and lower cost than the long-run 2025 range; reflects active pricing competition and lower bond yields. |

Existing Home Sales (SAAR): 3.91 M in January 2026 | Slowest pace since late 2023, winter weather partly blamed. |

Share of Listings with Price Cut: ~22% | Sellers still adjusting expectations. |

Money Management Making You Mad?

Most business owners hit revenue goals and still feel cash-strapped.

Not because they're not making money. But because their money flow is broken, their decisions feel urgent instead of strategic, and their systems feel fragile instead of solid.

The Find Your Flow Assessment pinpoints exactly where friction shows up between your business and personal finances.

5 minutes with the Assessment gets you clarity on:

where cash leaks

what slows progress,

whether your current setup actually serves you

No spreadsheets, or pitch. Just actionable insight into what's not working and why.

Educational only. Not investment or tax advice.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}