Welcome, prop.text readers!

In issue 48, we look back to the list of best markets for 2025 as well as look forward to the new best markets list for 2026.

publicly.traded → Best markets for 2026

industry.chatter → American’s moving to smaller cities

Where the Opportunities Are in 2026

When we sat down last year to pick our top 10 markets, we weren’t looking to follow the crowd and so our list had cities on it readers would not find on other top 10 lists.

It wasn’t the typical “Buy in Atlanta” or “Buy in Charlotte” selections. We looked for markets that we felt offered a strong upside without the competition found in more popular places.

Now, it’s time to check in and see how these markets have fared. We’ll remind you that one year is not the recommended period for an asset like real estate. Holding for the long term, letting equity build and taking advantage of tax benefits, is the best way to reap the full rewards of property investment.

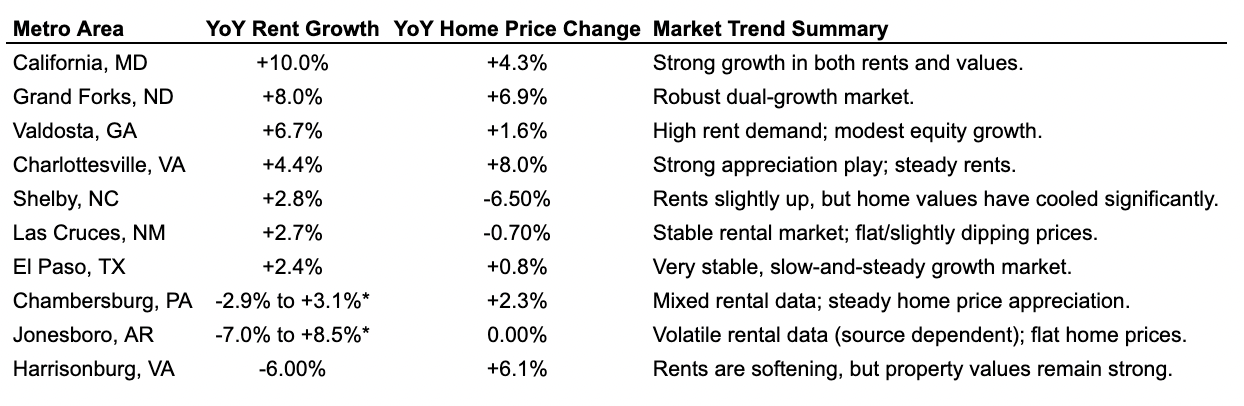

Here is a review of how 2025’s “Best Markets” from prop.text performed:

According to the National Association of Realtors, in 2025 the national median single-family existing-home price grew 1.7% year over year. As usual, we’ll point out that real estate is best measured by focusing on local markets, not looking at the country as a whole.

Prop.text’s list outperformed in six of the 10 markets, with price changes above the national average. Four of the 10 markets were flat or saw price drops year over year.

Rent growth was another bright spot for the markets on our list. Zillow’s Observed Rent Index (ZORI): showed a modest 1.7% year-over-year rise in November 2025. Seven out of 10 markets showed an above average rental growth year over year. For two markets, Chambersburg, PA and Jonesboro, AR, the rent growth had mixed data from different listing sites showing either rental growth or rental price declines. Harrisonburg, VA, saw a 6% rent decrease.

2026 Best Markets

This list, like last year’s list, should be a starting point. Always do much deeper research. A key theme for 2025 that will likely continue: the once-hot markets during the pandemic will continue to cool. We don’t think 2026 is the year to jump into Austin or Charlotte.

Pittsburgh

Pittsburgh, once the steel capital of the US, went through a steep decline when the industry cratered. The transformation began in the 1990s, as the city leveraged its great universities to become a center of innovation and technology. Recently, it has emerged as a robotics and automation capital.

Shaking off the rust actually started decades ago when Carnegie Mellon University founded the world’s first doctoral program in robotics in 1988. Self-driving cars have been part of research projects in the city since the late 1980’s, which is why companies like Google have a large presence in Pittsburgh.

The Pittsburgh Robotics Network lists “more than 250 advanced technology companies, offering 7,300+ high-impact jobs acro8 industry verticals, including autonomous transportation, defense, healthcare, agriculture, space, [and] manufacturing.” Robotics and self-driving are two trends for 2026 and likely more impactful (and real) than any AI chatbot hallucinating slop.

Investing in a city undergoing revitalizing isn’t without risk. The majority of the robotics activity is happening in Lawrenceville and the Strip District, areas referred to as “Robotics Row.” Homes in these neighborhoods and around Pittsburgh are often older, requiring larger renovation budgets. However, many of these homes also offer beautiful architectural details unavailable in new construction. As the US economy ages, robotics are going to be moving more into daily life over next 20 years positioning Pittsburgh as our #1 pick for 2026.

Columbus, Ohio

Ohio has been hit hard by the decline in American manufacturing and steel production and its large cities, such as Cleveland, Akron, Toledo and Youngstown, have been losing population for years.

Columbus, however, bucks that trend and is the only city in Ohio attracting new residents. It is one of the fastest growing metros in the Midwest, with expectations of further expan. Prop.text isn’t the only real estate site that expects a bright future for Columbus, mostly because of the investments in technology there. Intel has started a mega investment outside of Columbus, with an initial outlay of over $20 billion for two leading-edge chip plants on nearly 1,000 acres. There is the potential that the chipmaker will expand to six factories and reach $100 billion in total investment.

Richmond, VA

Richmond has evolved into the Mid-Atlantic’s premier “refuge market,” offering a 2026 investment profile defined by high-income migration. As return-to-office mandates and soaring costs push professionals out of Northern Virginia and Washington, DC, Richmond captures this overflow with a cost of living nearly 40% lower.

Richmond is no longer just a "local" market. It is part of a 100-mile tech and government corridor. Many residents now make the super-commute to DC two days a week or work remotely for Northern Virginia tech firms while paying Richmond rent. The 2026 forecast placing it in the top 10 nationally for combined sales and price growth, the market offers a rare window for appreciation in an otherwise normalizing national landscape.

Birmingham, AL

Birmingham has an attractive combination of a growing population, cheaper housing and attractive rents. It also offers a rare trifecta for 2026: a diversifying economy anchored by the University of Alabama at Birmingham (UAB) health system, a cost of living roughly 30% below the national average, and rental yields that consistently outperform higher-priced Sun Belt neighbors.

While the city remains one of the most landlord-friendly in the Southeast, its true “moat” lies in its stability, unlike the boom-and-bust cycles that are prevalent in Florida. In Birmingham, the "Medical Mile" is anchored by UAB, which is the largest employer in the entire state (28,000+ employees). This isn't just one hospital; it’s a huge network including the 8th largest public hospital in the nation, a major biotech and research hub.

Glen Iris & Five Points South neighborhoods are areas that offer historic single-family homes and small multi-family units (2-4 units) that are perennially occupied by residents and graduate students. Titusville has been traditionally more affordable, this area is seeing investment because of its proximity to the district’s western edge.

Greenville–Spartanburg, SC

The Greenville-Spartanburg corridor represents the blue-chip industrial play of the Southeast, offering a 2026 investment profile anchored by unmatched manufacturing resilience and an aggressive international corporate presence.

The local economy is driven by the “BMW Effect” and the Inland Port Greer logistics hub, which has effectively turned this landlocked region into a transportation center. Companies like Michelin, BMW, and Adidas are able to move goods directly to the Port of Charleston via rail. The region has transitioned from its textile past to a global center for automotive, aerospace, and life sciences, creating a high-multiplier job market where one manufacturing role supports 3.5 additional local jobs. Spartanburg remains one of the nation's fastest-growing metros by population (+2.7% year over year).

St. Louis

St Louis might seem like an odd pick. In fact, a look at the high-level numbers reveals a bleak picture: population in decline and an older home inventory. And yet, hidden in the data lies a rebound happening in St. Louis.

It’s becoming the national capital for Geospatial Intelligence (Map-based Defense Tech). The massive $1.75 Billion National Geospatial-Intelligence Agency (NGA) West Headquarters in North St. Louis. This isn't just an office building; it's a high-security federal campus that is actively reshaping the surrounding neighborhoods. The NGA doesn’t work alone. Their presence in St. Louis has attracted a cluster of private companies that specialize in drone tech. The NGA doesn't just bring 3,000+ federal employees to North St. Louis; it’s bringing an entire drone industry to the city.

Looking at the map of St. Louis, the area between the new NGA site and the Cortex Innovation Community is becoming the "Drone/Geospatial Corridor." Check for "Opportunity Zones" in the Downtown West and JeffVanderLou neighborhoods. If a property in these zones is held for 10 years, there is zero capital gains tax on the appreciation.

Chattanooga, TN

As the first U.S. city to offer 25-gigabit fiber internet to every home and business, Chattanooga is a magnet for a new class of “high-tech nomads” and remote workers who prioritize connectivity and outdoor lifestyle over big-city density.

Strategically positioned between Atlanta, Nashville, and Birmingham, the city serves as a critical node for the Southeast's “Freight Alley,” ensuring a steady dose of blue-collar employment to balance its tech growth. For investors, the play is a stability-first strategy: with zero state income tax and a cost of entry still significantly lower than Nashville, Chattanooga offers reliable 2026 cash flow with a built-in appreciation kicker from its aggressive downtown revitalization and riverfront expansion.

Harrisonburg, VA

This is the second year Harrisonburg makes the prop.text list. Anchored by James Madison University (JMU) and a robust poultry and manufacturing sector, there’s a growing professional class that is increasingly starved for quality single-family inventory.

Unlike the high-volatility coastal markets, Harrisonburg is a “linear” market where the primary driver for 2026 is a massive wage-to-price reset: household incomes in the Shenandoah Valley are currently climbing faster than home prices for the first time in five years. It is the ideal market for the conservative yield investor who wants a high-quality tenant base.

Louisville

The industrial “re-shoring” transformation, shifting from a traditional office economy to a global logistics and advanced manufacturing powerhouse is the story in Louisville. With Ford's new EV platform launch and GE Appliances shifting production back to Appliance Park, the city is attracting a wave of skilled-trade workers. It’s also a logistics hub: there’s UPS Worldport hub, the largest automated package-handling facility in the world.

Columbia MD

WalletHub found that Columbia has the highest median household income in the US — when adjusted for cost of living — at $129,000, which contributes to its ranking as the second-best city for jobs in 2026.

The city's affordable rent also helped solidify its ranking. A two-bedroom apartment costs around 16% of the median household income, which is the fifth-lowest percentage in the US.

Columbia's job market is ranked third overall. Its socioeconomic factors are ranked fourth.

Americans are moving to smaller cities for cheaper housing and a better quality of life, as well as to be near family members, according to the 49th Annual National Movers Study from United Van Lines. Oregon was the most popular destination for the first time in 2025, with West Virginia and South Carolina right behind. Some 36% of Oregon’s new residents were job seekers, pursuing opportunities in growing tech and health care fields. Florida and Texas saw more balanced migration. For the eighth straight year, more residents moved out of New Jersey than any other state, but is still attracting those looking to launch their careers, while retirees are leaving for affordability and lifestyle reasons. Migration patterns show that while New Jersey, New York, and California are seeing more outbound traffic, they are still attracting ambitious younger people.

Los Angeles renters no longer have to bring their own refrigerators when they move in, and take them when they move out, thanks to a California law that went into effect on Jan. 1. Until Gov. Gavin Newsom signed the law mandating landlords provide a working stove and fridge, which many cities in California and most of the rest of the country required, tenants in LA relied on a network of used appliance shops and a robust online market. Incoming and outgoing renters often worked out fridge deals, and some landlords rented them by the month. There was an old joke that many Angelenos own their refrigerators but not their own homes.

Goodbye, lock-in effect? More Americans now have mortgage rates higher than 6 percent than below 3 percent, and the incentive to keep the lower rate and stay in place is beginning to fade. But more than half the mortgages now held are below 4 percent, so the lock-in effect will affect the market for a while, according to Redfin chief economist Daryl Fairweather. He says rates below 4 keep many sellers in place, and added that buyers won’t see a big shift immediately. “It’s becoming less of a problem the more that time goes on, but it’s a slow unwinding,” Fairweather said. “It’s probably going to be another four, five years of it being a major factor in the housing market.”

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Refer and Earn

You can earn free prop.text merch for referring investors to the newsletter

25 referrals - hat 🧢

50 referrals - tee shirt 👕

100 referrals - weekender bag 🎒

Copy & paste this link: {{rp_refer_url}}